January 2022 UK Housing Market update

Recent weeks have seen the publication of several end-of-year and monthly reports from the likes of Hometrack, Nationwide and Halifax.

All tell a similar story, with annual house price continuing to grow off the back of 2021’s record levels. Annual high price growth has been measured as follows

- Zoopla (Hometrack) – 7.4% (figure for December)

- Nationwide – 11.2% (figure for January)

- Halifax – 9.7% (figure for January)

Nationwide highlight that January’s annual house price increase marks it out as the strongest start to the year for 17 years. According to the Halifax, overall average house prices is approx. £24,500 up on this time last year, sitting at a new record high of £276,759.

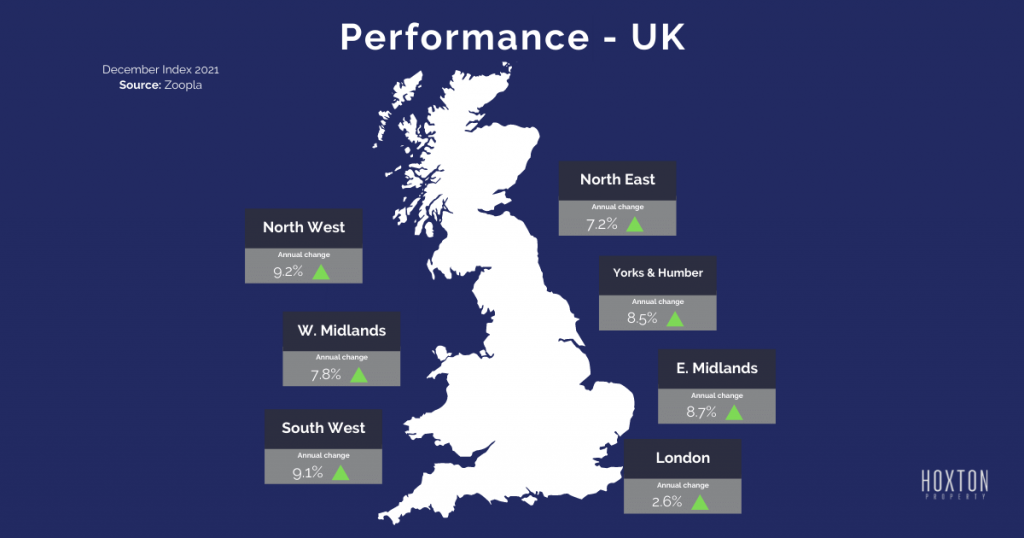

Regional variations – North West booming, London bouncing back

Of course, the UK housing market is varied in both stock and regionality. Continuing the trend, London has remained the weakest region for growth, but there are more signs that the market here is rebounding. Annual house price inflation in the capital has accelerated for a third straight month to now stands at 4.5% (source, Nationwide).

The North West of England continues to be England’s top performing region for house price growth. Zoopla highlights that Manchester and Liverpool are seeing price growth of 107% and 8.7% respectively. This contributes to the North West’s overall average increase of a healthy 9.2%.

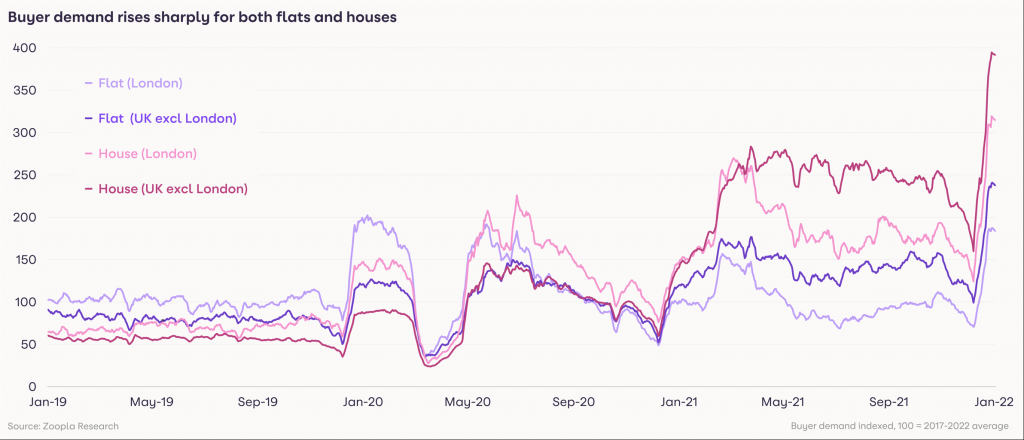

Buyer demand still high

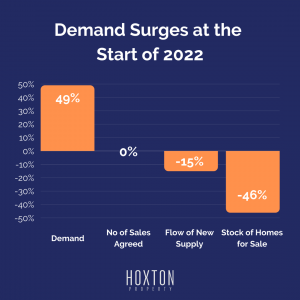

The UK property market continues to experience high demand and low supply.

We regularly tell our investors that the UK property is so attractive because of this feature. It’s one of the reasons why house prices continue to rise so much.

With a growing population, and housing stock not keeping up, buyers and renters will always need somewhere to live.

Source – Zoopla.

Zoopla pulls out the exact figures; “There is still a significant imbalance between supply and demand. Looking at stock levels against a five-year average, they are -44% lower.”

Rental growth rises to 8.3%

UK annual rental growth for new lets rises to +8.3% in Q4 2021. Once again, this is fuelled by huge demand amid low supply.

Although rental costs are up, they have remained broadly in line with 10-year affordability measure averages. Rent as a proportion of gross income has averaged 36% for a single earner over the last decade. In December, it rose to 37%, so not a major change.

Of course, this should be viewed against other general cost of living increases such as the upcoming fuel price cap rise and high inflation in the UK. Whilst landlords may be able to push rents higher, there is a risk this will price would-be tenants out of the market, leading to costly void periods.

Will the market cool in 2022?

The simple answer is “yes”. All sources predict 2022 will see generally lower house price growth in the UK property market.

For investors, this may have an impact on short-term capital growth, but it’s unlikely to hit rental yields too hard.

Rental affordability is in line with historic averages. Although squeezed at the bottom end of the market, investors picking the right apartments in growing, affluent locations, will still be able to enjoy good returns.

Regional variations mean that it’s still possible to beat any market downturns.

Capital growth in regions like the north west (as mentioned above) far outstrips the UK average.

In terms of yield, monthly average rents in Manchester and Leeds have grown year-on-year by 9.5% and 9.6% respectively.

Any investor that has picked up properties in these locations will be very happy with their recent returns.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.