IS UK PROPERTY A GOOD INVESTMENT IN 2022?

The best time to plant a tree was 20 years ago, the second-best time is now – Chinese proverb.

Property is always a long-term investment and just like any investment, over a long enough timescale you can absorb market fluctuations. Even larger events, such as recessions, will even out in the long run.

While there might never be a “bad” time to invest in property, there are three main reasons why 2022 is looking like a particularly good time to invest

- Market Forecast

- Rental Demand

- Interest Rates

Market Forecast

It is impossible to accurately predict how the value of any investment will change over time, and past success is not a reliable indicator of future performance. With property, however, we can make reasonable predictions based on the future housing needs of a growing population.

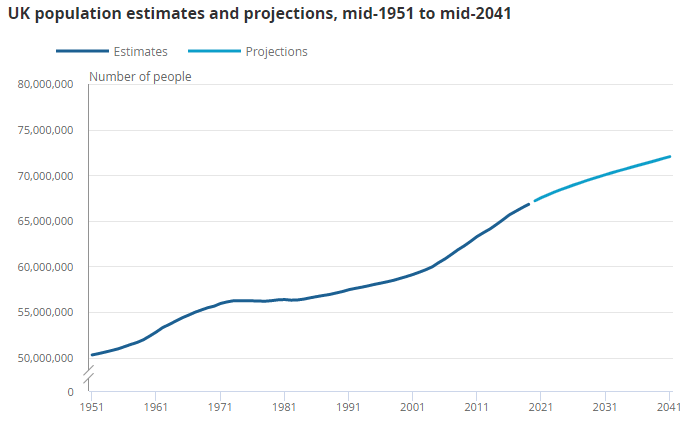

In the last 20 years, the population of the UK has increased by just under 10 million. This growth rate has remained steady and is a useful indicator for the future demands of the housing market.

One benefit of property investing is that people will always need homes, regardless of social status or income level.

The UK Government has announced a target of 300,000 extra homes to be created in the UK per year on an ongoing basis. This is to help address the current under-supply of suitable accommodation for the growing population.

Although this is a good start, the development of new homes still falls substantially under the required demand every year.

Basic economics tells us that when something is in short supply, the cost to purchase it will increase. We can therefore reasonably predict that housing prices will increase over the coming years.

Rental Demand

Millennials are having a hard time getting on the property ladder. Increasing house prices, stagnant wages and the growth of the gig economy as opposed to “jobs for life” are all indicators that homeownership may not be as achievable as it used to be.

The younger generation is likely to travel more, work remotely and desire greater freedom and flexibility in their lives. Renting provides individuals with greater flexibility and a more affordable option for housing.

Buy-to-let properties provide benefits for both the landlord and the tenant. The tenant profile has also changed in recent years and people of all ages, all incomes and all demographics are now interested in renting. If an investor finds a great property, keep it well maintained and affordable, they can attract fantastic long-term tenants.

Interest Rates

When purchasing a property through leverage, the lower the interest rate on the mortgage the better. Interest rates in the UK are at an historic low and are not likely to increase significantly over the next few years.

This creates a perfect buying opportunity and means that while debt is cheaper, you have a better opportunity to build a robust portfolio. We often advise using the bank’s money to finance your property purchase, rather than yours! Now is the ideal time to take advantage of the rates available.

Property investment offers a unique way to take advantage of low-interest rates because you can benefit from two types of return – capital growth and passive income. By maintaining a sensibly leveraged portfolio and taking advantage of economic conditions, 2022 can be the perfect time to buy.

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.