September UK House Price Index

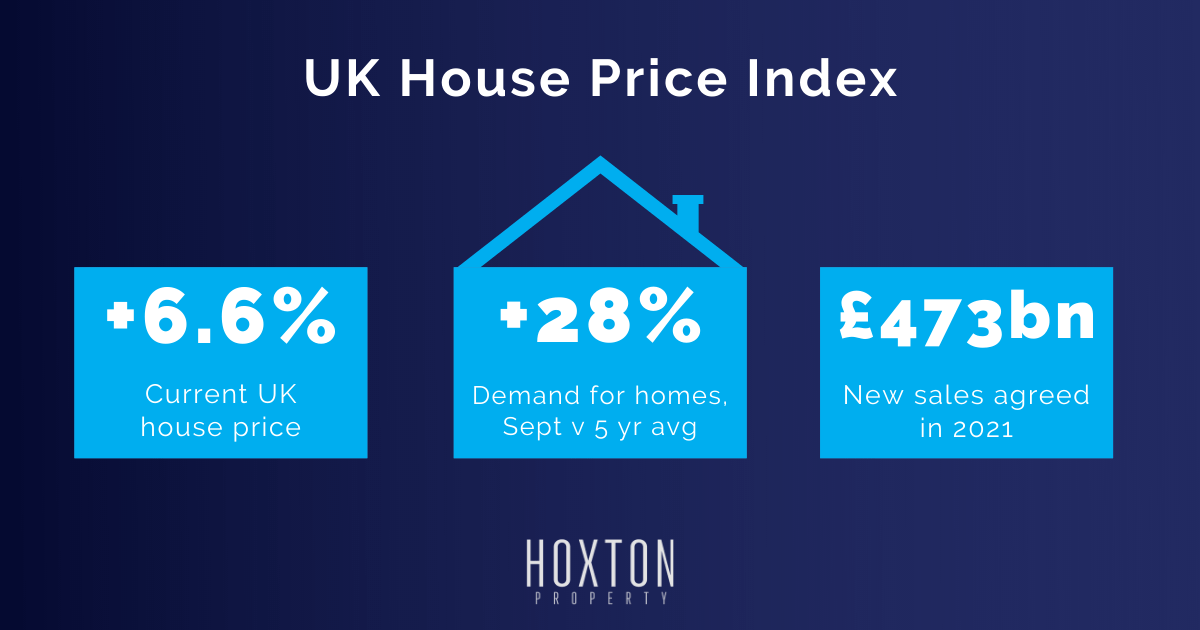

September’s Hometrack UK price index report has revealed 2021 to be a record year for the UK property market. Sales are set to top £473bn, beating the 2020 level by £95bn.

Whilst the stamp duty holiday in 2021 helped add additional demand, there’s been no sharp downturn since it ended. Low mortgage rates and a general re-evaluation of needs prompted by the pandemic have kept the market buoyant.

+6.6% – Current UK house price growth

UK house price growth is currently at 6.6%, which is up on last month and well ahead of the 5 year average.

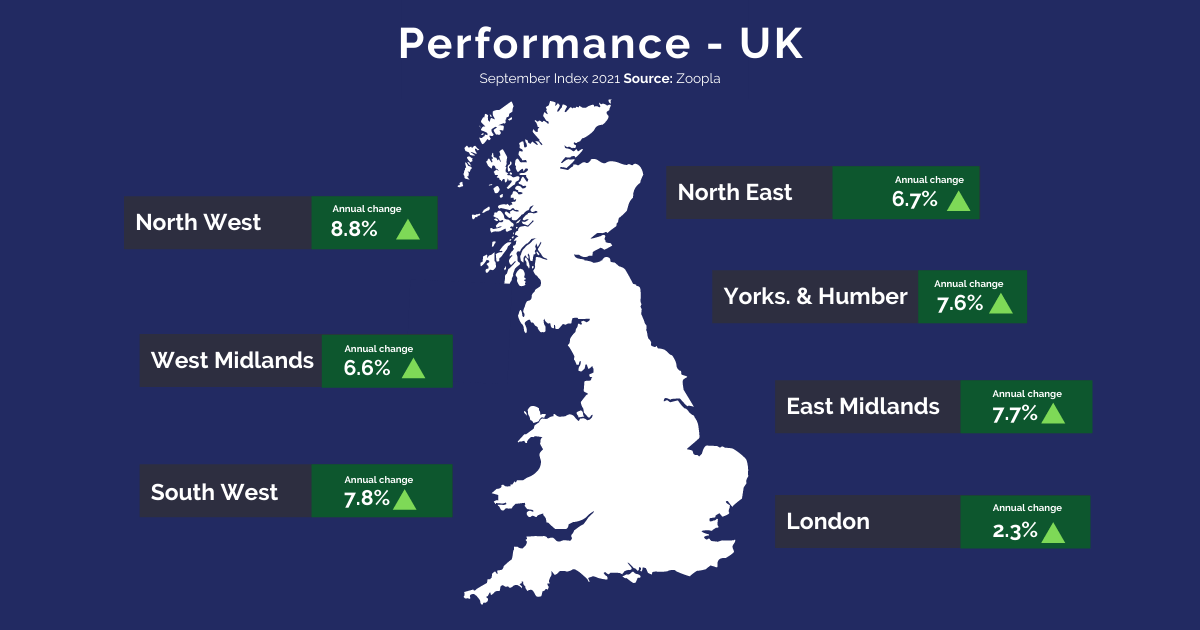

All UK regions have seen an increase in house prices apart from London. The North West, a buy-to-let hotspot for investors, has seen year-on-year growth of a massive 10.4%. Liverpool is currently seeing an annual house price growth of 10.4%, Manchester is hitting 8.7% and Sheffield recorded 7.8%. Further south, Birmingham saw 6.1% annual growth whilst Nottingham and Leicester saw 7.3% and 7.2% respectively.

Any investors purchasing in these markets will already have seen good growth on their capital.

+28% – Buyer demand mid-September vs five-year average

Buyer demand continues to outstrip supply in the market. In positive news for investors, this means that there’s still a steady supply of renters, unable to buy yet, looking for accommodation. Hometrack predict a lack of homes continuing in to 2022.

+3% – House price growth predicted in 2022

Looking ahead to next year, the report suggests that house price growth will slow overall to 3%. Nonetheless, regional hotspots are predicted to see further rises. Key to this is affordability, with those areas with more affordable stock likely to see better growth in house prices.

This is good news for investors purchasing outside central London, with the commuter belt and the North West both predicted to continue their positive growth next year.

A boom on the horizon for London?

Interestingly, Hometrack suggest signs of life in the London property market, drawing parallels with the aftermath of the global financial crisis. With a tightening of supply and the city returning to pre-Covid levels of activity, they think we might see a strong rebound in this market.

About Author

Post Tags

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.