For the first time since December 2012, the Halifax House Price index has reported a year-on-year fall in UK property prices.

According to the Halifax, average house price remained flat in May month-on-month after having recorded a 0.4% fall in April. Although Hometrack paints a slightly different picture in terms of details, suggesting UK house prices have fallen by 1.3% over the last 6 months, the general trend of a softening in the market is clear.

A varied market

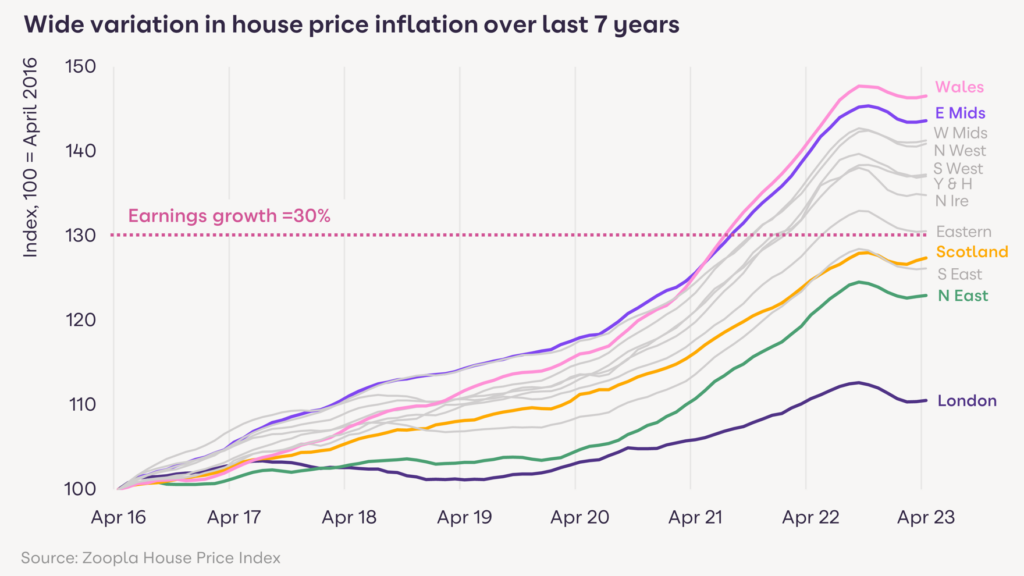

As ever, the average does not tell the whole story, with pockets of the country and certain types of property still seeing growth.

For example, Halifax point out that new build prices are still rising at +2.8% with detached properties benefiting slightly from a +0.4% year-on-year increase.

On a regional level, the West Midlands (+2.7%, average price £251,137) remains the best performing region, followed by Yorkshire & Humberside (+2.3%, average price £205,035).

These areas are in contrast to the south of England in general, where higher prices are the first to feel the rising cost of borrowing. Greater London prices are down over the last year by 1.2% (average price £536,622) and prices in the South East have fallen 1.6% annually.

Why are house prices coming down?

Consumer price inflation is still high in the UK, with inflation rates falling less than expected in April by 8.7%. This has led to most financial analysts to predict further rises in the Bank of England base rate. Indeed, some are forecasting this could rise to as much as 5.5% as Threadneedle Street continues to hammer the only lever it has.

In the wake of this inflation data, a higher base rate and movements in gilt yields, mortgage lenders have been increasing rates. To make matters worse for would-be house buyers and movers, over 800 mortgage deals were pulled at the end of May whilst two-, three- and five-year fixed rates have all been creeping back up after a brief period of fall over spring.

Simply put, if the cost of borrowing goes up, homebuyer confidence is hit meaning sellers will have to drop prices to find a buyer.

Kim Kinnaird, Director, Halifax Mortgages said, “As expected, the brief upturn we saw in the housing market in the first quarter of this year has faded, with the impact of higher interest rates gradually feeding through to household budgets, and in particular those with fixed rate mortgage deals coming to an end…This will inevitably impact confidence in the housing market as both buyers and sellers adjust their expectations, and latest industry figures for both mortgage approvals and completed transactions show demand is cooling. Therefore, further downward pressure on house prices is still expected.”

What does this mean for buy-to-let investors?

Do falling house prices mean that UK property is now a bad investment?

No, not at all.

Firstly, the picture is far from clear, with regional variations, property variations and even some disagreement about how much prices are moving down.

What is clear, is that most analysts are suggesting price correction is on the cards, rather than price crash. As long as mortgage rates don’t go too far above 5%, Hometrack estimates that there will be minimal impact on overall house price, stating, “Our assessment remains that mortgage rates of 4-5% are consistent with house price growth of +2% to -2% and circa 1 million sales a year, so long as we continue to see a strong labour market.”

Long-term investing and property as a store of wealth

Of course, property investment is a long term investment, We recommend our clients think of their property investment as at least a 10 year project. The history of UK property shows that there has never been a ten year period where house prices have fallen.

Additionally, with inflation still running high in the UK, property continues to be a robust store of wealth that beats leaving money in the bank. Even without capital appreciation in the short term, investors will see returns in the form of rental yields that will go some way to making sure their money is holding on to its value.

Affordability challenges are landlord opportunities.

The fact remains, that for many people in the UK, buying a house is out of reach.

Added pressure from higher mortgage rates, stronger stress tests from lenders and the ongoing cost of living pressure means that renting is the only option for many millions in the UK. In this situation, private landlords and buy-to-let investors will find that their properties are in high demand.

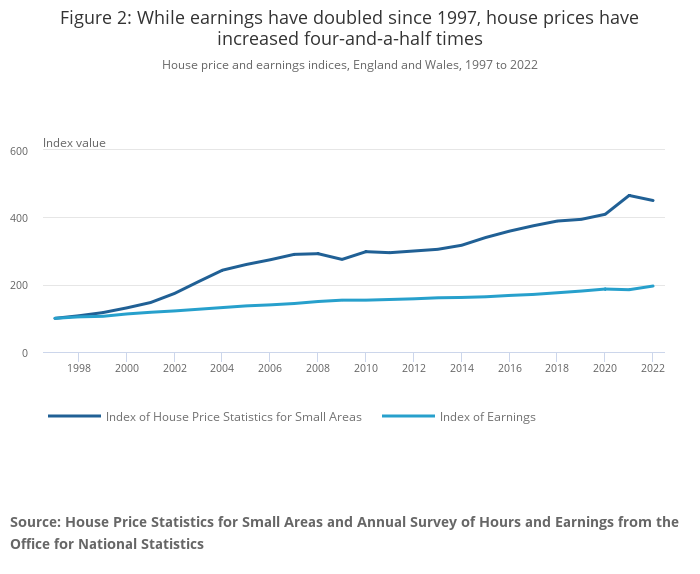

The Office for National Statistics demonstrates that whilst earnings may be increasing, house prices are increasing faster. This means that in England, full-time employees could expect to spend 8.3 times their earnings on purchasing a home in the local authority area they work in.

As the graph above shows, even a small recent drop in house prices isn’t going to significantly close the gap between earnings and house prices. This is where investors are able to make gains.

How to make property investment work for you in the current climate

There are some simple points to follow that means it’s still possible to make property investment work for you.

– If you’re borrowing, use as large as deposit as you can to secure lower rates on your mortgage

– Work with shorter terms on your mortgage and be prepared to shop around for lower rates when market conditions are more favourable.

– Look for high yields to offset interest rates or poor capital growth in the short term

– House prices aren’t falling everywhere – find somewhere in the UK where prices are still on the up

– Look at the bigger picture. Market conditions won’t remain as they are forever. Getting in now is better than leaving your money in the bank where you’re guaranteed to be suffering from inflation.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.