UK rental growth is at its highest level in 13 years. Zoopla has released their latest insight on the UK rental market, looking back at the last quarter, highlighting the return of city centre renters and an ongoing imbalance between supply and demand.

UK rental growth is at its highest level in 13 years. Zoopla has released their latest insight on the UK rental market, looking back at the last quarter, highlighting the return of city centre renters and an ongoing imbalance between supply and demand.

UK rental growth at its highest rate since 2008

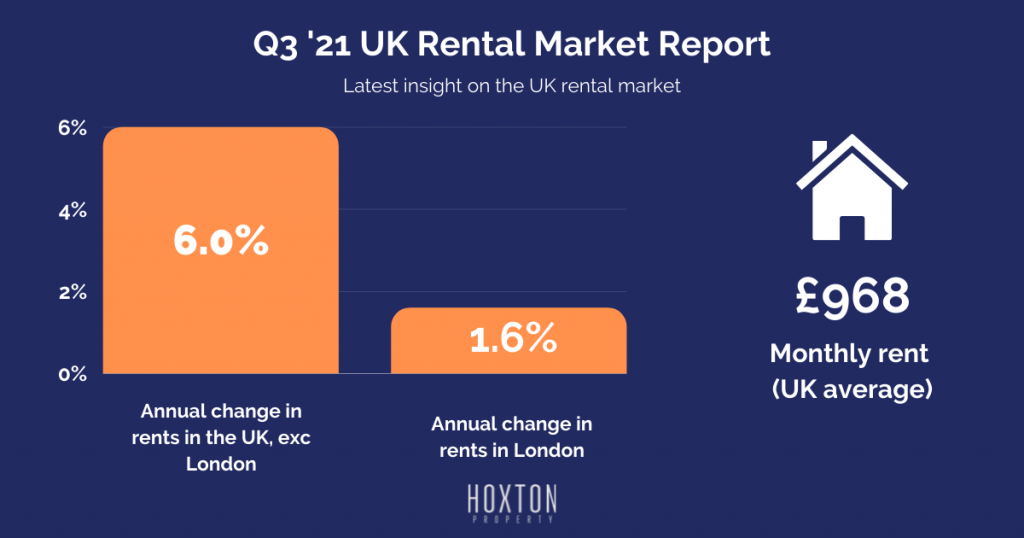

Average rents are up 4.6% year-on-year for the end of September ’21, after city centres saw a return to “normal” life as the UK emerges from the pandemic.

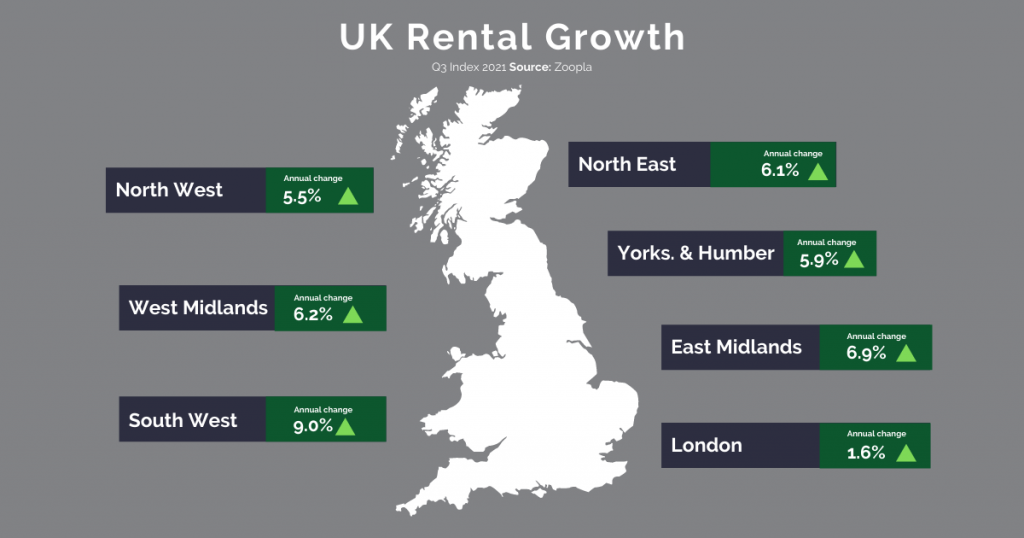

Office workers and students have come back, leading to average rents outside London increasing 6% year-on-year. The South West of England saw the fastest rental growth, with a 9% increase, whilst buy-to-let hotspots like Manchester, Liverpool and Nottingham saw increases of 4.7%, 6.1% and 8.3% respectively.

These increases mean higher yields for buy-to-let investors. There is a strong market for their properties, with professional renters willing to pay more to secure their housing.

+1.6% – annual change in rents in London

London rental prices are still lagging behind the rest of the country, with annual rental growth at 1.6%, proving that the market still offers slim yields for most investors.

Nonetheless, Zoopla see strong signs of life in the capital, with quarterly rents up 47% in Q3 vs Q2. There is also increased activity, with tenancies agreed 50% above the 5-year average.

They predict 2022 will see rental growth in London sustained at around 3.5%.

Supply and Demand imbalance

We often advise new investors to take advantage of the imbalance between housing supply and demand in the UK. Bringing your asset to market at a time of high-demand means you can avoid costly vacant periods and see higher rental yields.

The average time to let a property in the UK remains just 15 days, and is a mere 10 days in the South West. Demand is 43% higher than supply, meaning those investors who do have buy-to-let accommodation available to rent, will likely find a tenant.

The employment market appears relatively robust, with record job vacancies currently. This in turn means a steady audience of professionals who want to rent to whom investors can market their properties.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.