National insurance, is it worth it?

Is national insurance worth it? In our opinion yes, it is absolutely worth it and here is why:

National Insurance Contributions (NICs)s give you entitlement to certain state benefits, such as:

- Contribution-based jobseeker’s allowance

- Bereavement allowance

- Contribution-based employment and support allowance

- Universal Credit

Gaps can be explained by being unemployed and not claiming benefits, or by earning below the contributions threshold for both employed or self-employed. Or simply by ceasing contributions when you move abroad. Gaps can mean you will not have enough years of NICs to get the full State Pension (sometimes called ‘qualifying years).

It would be a shame to lose out on your full pension because of missed contributions, especially if you’re only abroad for a short period of time. Thankfully, there are options for plugging those gaps! Those living in non-EU/EEC countries or countries without a bilateral social security agreement.

Bilateral social security agreement

Firstly, you need to check your NI record to find out:

- (a) if you have any gaps – if yes, proceed to scenario (b)

- (b) if you’re eligible to claim credits – if yes, proceed to scenario (d), if no, proceed to scenario (c)

- (c) if you’re eligible to pay voluntary contributions – if yes, proceed to scenario (d), if no, look at your other options regarding pensions!

- (d) how much it will cost versus the benefits

Scenario (c) Up to 6 years’ voluntary contributions can be back paid. Generally, eligible expats can pay Class 2 NICs which count towards their State Pension when they retire and entitle them to Employment and Support Allowance and bereavement benefits if and when they return to the UK. There are also deadlines and time limits for paying voluntary NICs. However, HMRC has extended the time limit if the person reaches State Pension age on or after 6 April 2016 and makes payment by 5 April 2023. The rates payable will depend on the timeframe in which contributions are made.

Benefits

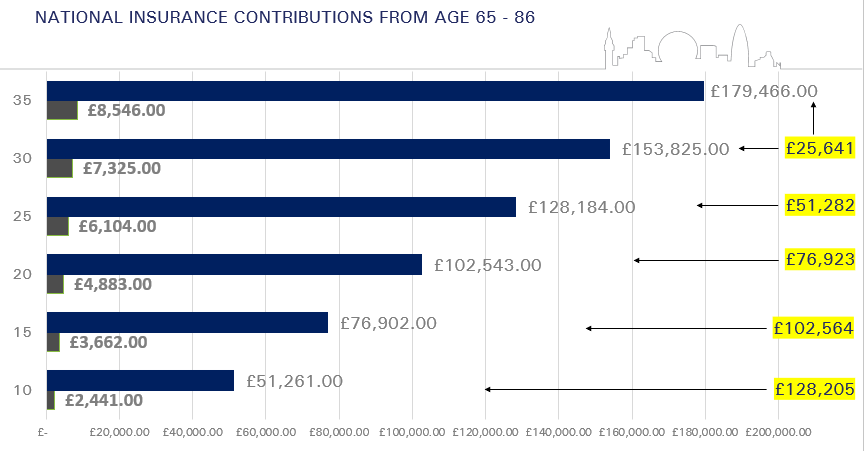

- Full state pension is currently £164.35 per week or £8,546.20 per year. To receive this amount you require 35 full qualifying years.

- Class 2 voluntary contributions are £2.65 per week or £137.80 per year.

- Class 3 voluntary contributions are £13.25 per week or £689 per year.

The average life expectancy in the UK is currently 86, so someone receiving full state pension benefits will receive £179,466 over the course of their retirement.

On average the expats we come across are missing 10 years of contributions. Assuming they also live to 86 they would receive £128,184 over the course of their retirement. That’s £51,282 less.

If the expat missing ten years paid those voluntarily on Class 2, it would cost them £1,378. So assuming they live to 86, that’s a return of 3,721.48% on what they paid in.

What to do

HMRC recommends taking independent financial advice regarding NICs, and our consultants can assist with checking your record, determining the path forward and completing the various forms.

If you know you need to look into this or are unsure about your options please get in touch with us and we will be happy to help.

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.