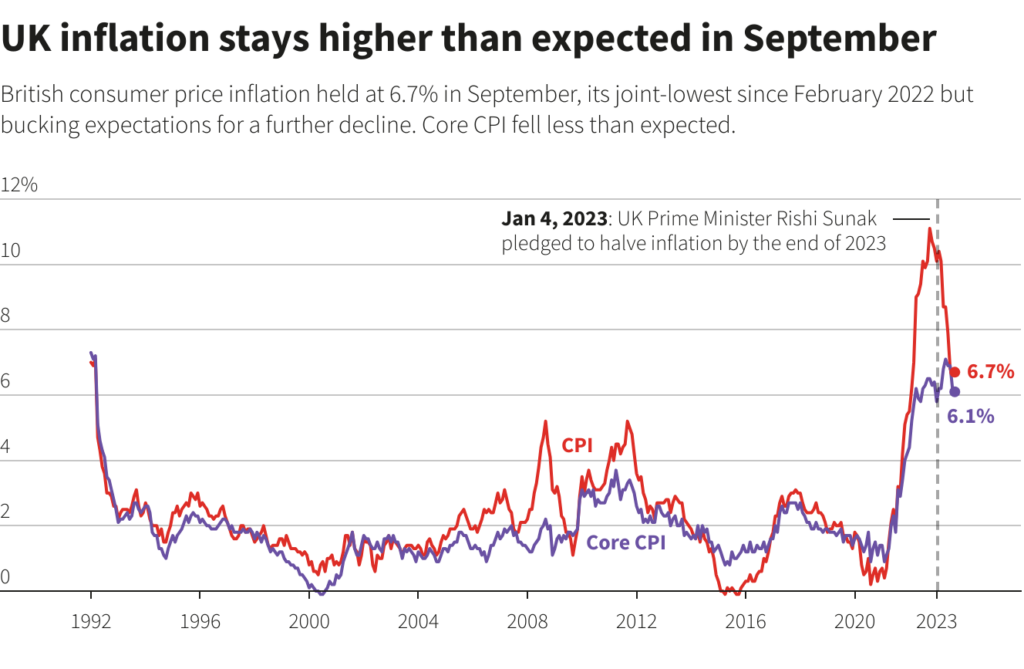

UK inflation remains steady at 6.7%

The rate remained stable in September, sparking uncertainty regarding the upcoming interest rate decision by the Bank of England.

- UK inflation stable at 6.7%, the lowest since February 2022

- Services inflation shows an increase, with core CPI exceeding forecasts

- Market expectations were for CPI to decrease to 6.6% in September

- Bond prices experience a decline, and the value of the sterling rises due to the possibility of a Bank of England rate hike

- Economists predict a significant decrease in inflation for October

Headline Inflation Holding Strong

British consumer price inflation (CPI) has unexpectedly held steady at 6.7% in September, marking the highest rate among major advanced economies. This surprising figure raises the prospect of another interest rate hike by the Bank of England (BoE).

Petrol Prices Bolster Inflation

The Office for National Statistics reported that a surge in petrol prices from August to September was the primary factor preventing a decline in the annual inflation rate. This outcome underscores the ongoing economic challenges.

Long-Term Price Concerns

While headline inflation remains elevated, two other vital metrics closely monitored by the BoE—core inflation and services prices—also exhibited resilience. This inflation persistence will likely raise policymakers’ concerns regarding enduring price pressures.

Market Reactions and Rate Hike Speculation

Following the release of this data, the value of the British pound strengthened while government bond prices declined. Financial markets are now weighing the possibility of another rate increase by the BoE. However, the timing remains uncertain, not necessarily as soon as November 22, when the central bank unveils its next decision.

BoE’s Expectations and Recent Rate Decision

Despite September’s figures, headline inflation still falls below the initial forecasts made by the BoE in early August. Some economists argue that this minor deviation is insufficient to trigger the resumption of the BoE’s rate-tightening cycle.

Last month, the BoE chose to keep interest rates unchanged, a notable departure from the series of increases that commenced in December 2021. This decision was influenced by the unexpected drop in inflation in August and other indications of economic softness.

Source: LSEG Datastream | Oct 19 2023

Government’s Inflation Concerns

Inflation is not just a central bank concern; the British government also closely monitors the situation. Prime Minister Rishi Sunak, in January, pledged to halve inflation, and many households have felt the impact of reduced purchasing power as wages struggle to keep pace with rising prices. Food prices, especially problematic for low-income households, were 12.1% higher in September than last year.

Core Inflation and Services Price Rise

Core inflation decreased from 6.2% in August to 6.1% in September. Core inflation excludes volatile elements such as food, energy, alcohol, and tobacco, offering insights into longer-term price trends. Additionally, services price inflation, a component analysed by the BoE to assess the impact of rising domestic labour costs on consumers, escalated to 6.9% in September, primarily driven by the increased cost of hotel accommodations.

Historical and Forecasted Inflation

CPI reached an astonishing 41-year high of 11.1% in October 2022 due to surging European energy prices prompted by Russia’s invasion of Ukraine. This was further compounded by supply chain disruptions and labour shortages from the COVID-19 pandemic. In September, the inflation rate of 6.7% ties with the lowest level seen since the Russian invasion in February 2022.

In the BoE’s most recent forecasts from August, it was anticipated that inflation would remain above the 2% target until early 2025. However, many economists are predicting a sharp drop in CPI for October, as household energy bills will no longer be compared against the much lower prices of the prior year before a substantial increase in regulated tariffs in October 2022.

ING’s Inflation Projections

Dutch bank ING foresees British inflation dropping to 5% or lower in October and remaining at this level for the rest of the year, provided there are no significant increases in oil prices. These insights offer a glimpse into the potential trajectory of inflation in the coming months.

Disclaimer: The information on this website is directed only at persons outside the United Kingdom and must not be acted upon by persons in the United Kingdom. The views and opinions expressed should not be construed as investment or financial advice. The information contained is for educational purposes only. The information contained is up-to-date and relevant as of 19/10/23.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.