The world is changing fast. Investors need to understand how, and identify companies positioning themselves to benefit.

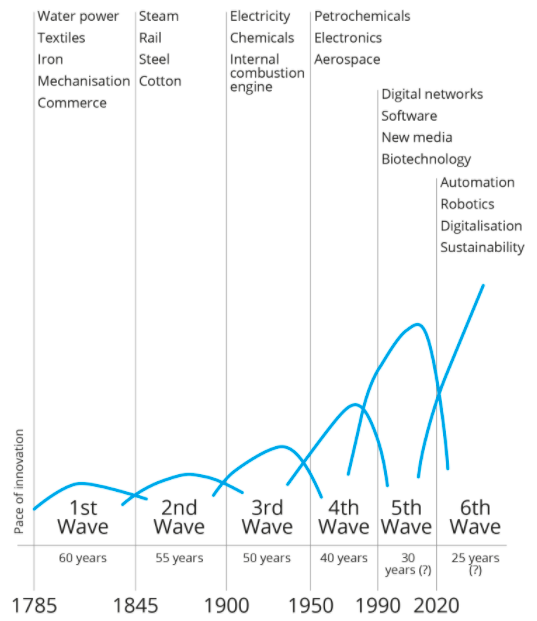

Innovation is the life blood of economic growth, and growth is what investors are looking for. We can point to six major waves of innovation over the last 250 years, from water and steam power to automation and digitisation. The first five proved to be durable drivers of growth over multiple decades. Finding innovative companies able to ride future waves will enable investors to benefit by owning the next drivers of long-term economic growth.

Innovative companies find ways to adapt and prosper; they don’t remain static and allow themselves to stagnate. Content platform provider Netflix2 provides an example. It started out sending rental DVDs to customers via online orders, disrupting the business model of video rental firm Blockbuster, among others. Ironically, Blockbuster turned down the opportunity to buy Netflix for $50 million in 1997.

Fast forward to today, and Netflix has become one of the largest buyers and creators of content globally with some 200 million subscribers, whereas Blockbuster filed for bankruptcy in 2010. It underlines how an unwillingness to adapt and expand can lead to decline.

One key characteristic to look for in companies is strong investment in research and development. That spend is what powers innovation, drives new product development and propels company revenues.

What innovation looks like

There are many and varied examples of successful innovation. However, one thing is consistent. To unearth innovation, investors first need to understand a company’s culture and purpose fully.

Innovative companies tend to fall into three categories: disruptors, improvers and enablers. While many people own some large, high-profile global companies, finding less well-known small and mid-sized firms which are equally effective innovators can be highly beneficial for your portfolio.

In the industrial sector, for example, there is a disruptive company that is revolutionising the textiles market. It makes digital inkjet printers for clothing and homeware decoration. Its direct-to-cloth printing uses a lot less water than traditional analogue methods, while localised services cut down on the logistics of transferring goods around the world. Covid-19 has expedited trends for smaller batch runs with less inventory, zero waste and more environmentally friendly methods of printing fabric. The global print textiles market is worth $165 billion, of which digital prints accounts for 5%3 . That points to strong growth potential.

Companies can also use innovation to improve their competitive advantage. Microsoft, for example, is a very different company to 10 years ago. It evolved by creating and investing in services for cloud computing and upselling to customers – driving its revenues and profit margins and consolidating its position as market leader. In effect, innovation prevented it from being disrupted by competitors.

Enablers, meanwhile, are companies that innovate to help other businesses achieve their objectives. Payments processing companies, for instance, which have continued to deliver strong results during the pandemic.

Framing the investment universe

Traditionally innovation was closely associated with information technology (IT) companies. However, technology has evolved in recent decades to become integrated into almost every aspect of people’s daily lives. It is advancing across service and production industries in areas such as digital interconnectivity, artificial intelligence, robotics, 3D printing, quantum computing, biotechnology, materials science and energy storage.

These technologies are disrupting almost every industry in every country. What matters today is a company’s ability to harness technology to build and sustain competitive advantages. Companies employ innovative tech across health care, consumer discretionary, communication services and industrials. As a result, investors need not restrict themselves to the tech sector to find the world’s best innovators.

Looking for companies that use innovation to address the needs of new generations of consumers, make businesses more efficient and help to protect the planet will be the companies of the future. Targeting those firms whose growth will be driven by durable changes in the way societies work, play, make things, save, spend and live will make for a solid portfolio over the long run.

For example, good investors consider how cities are developing, how health needs are changing and how transport is evolving. We know that people are increasingly conscious about minimising their impact on the natural world, driving companies to make things more efficiently – such as through automation and electrification.

Evidently the pandemic has accelerated trends in the way people spend and save in areas such as contactless payments, ecommerce and financial technology more broadly. In addition, the nature of the workplace and structure of the workforce is changing. More people are working from home, driving increased digitisation and use of cloud computing.

How people use technology to communicate with one another is also evolving, with the transition to 5G already underway. People will continue to seek to enhance their experiences in areas such as gaming, as well as travel as lockdowns are lifted and borders reopened.

ESG and engagement

Risks and opportunities surrounding ESG issues can be financially material, so these factors should be research them with the same rigour that investors apply to other financial risks. To summarise ESG, the ‘E’ deals with how companies interact with the environment: what they consume, discharge, dig up or leave behind. The ‘S’ deals with the way companies interact with employees, government, society and vendors. The ‘G’ refers to the overall governance of a firm: how well it is managed. All three elements are key in understanding a company’s worth.

It is crucial that companies identify and take pre-emptive action against ESG issues that could cause disruption, from data breaches to supply-chain risks to discontent among staff that could prompt turnover of key personnel and loss of knowhow.

Firms able to showcase how they safeguard customer data, prioritise environmental sustainability, foster a good staff culture and maintain standards among their supply chain will resonate with consumers. That will drive their profitability, and also their share price. Companies with strong ESG credentials will be the long-term winners.

Yet even now, some companies regard ESG as more of a PR activity than a business imperative. The game-changer will come as they realise that ESG is not only a means to manage risks, but also to drive returns.

Innovation and the pandemic

In hindsight, 2020 was a year of dramatic change. The pandemic accelerated the adoption of digitisation, cloud computing and ecommerce as people stayed at home and ordered goods online, while also encouraging new payment methods and ways of working.

Electrification and automation continues to gather momentum, and personal health is growing in importance for consumers in light of the focus that Covid-19 has placed on maintaining a healthy lifestyle.

These are long-term growth themes that investors can gain exposure to by identifying companies that have adapted, innovated and are in line to benefit.

In many ways the pandemic has served to highlight the competitive advantages of high-quality companies, as their balance sheet strength enables them to weather this economic maelstrom better than many competitors.

Importantly, though, investors should aim to invest in companies over the long term – for 5-7 years at least – and view the pandemic as a short-term blip. As such, Covid-19 should not unduly impact our investment decision-making, nor lead to investors rotating in and out of companies because of it.

As an investor, ignore the short-term noise and invest in companies over the long term. That’s where we think the greatest gains will be made. After all, the noise is constant and often exaggerated, even unfounded. There are some fantastic examples from the recent past of some of the noise that has since been seen to be incorrect.

For example, in 2010 an open letter was sent by eminent economists and professors, to Ben Bernanke, Chairman of the US Fed, informing him he’d made a dreadful mistake introducing Quantitative Easing, and that it should abandoned immediately because it would lead imminently to high inflation and recession.

In Jan 2010, Business Insider carried this headline “US stocks surge back towards bubble territory,” featuring research by Nobel Prize winner Robert Shiller which stated that his “cyclically adjusted P/E ratio shows US stocks are now more than 30% overvalued”, and then it went on to predict that US stocks were priced to return no more than 3% to 4% a year for the next 10 years, after inflation. The US S&P 500 index total return since has returned about 4 times that. Fellow Nobel Prize winner Paul Krugman, also feted for accurately predicting dire economic events, on the 8th November 2016 wrote this in the New York Times – “If the question is when markets will recover, a first-pass answer is never.” The S&P 500 is up 83% since.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.