Over the last 5 or so years leading up to the market crash we saw this year, there was a growing trend of DIY investor gurus propagating the idea that obtaining advice on your finances was nothing more than an additional expense for something you could simply do yourself.

In fairness, up until a few months ago they perhaps had a point. Given that markets had been steadily rising over that period, it was difficult for any fund manager to outperform and it didn’t require much skill to grow a portfolio. As such the idea that doing things yourself was better since it is marginally cheaper, became increasingly popular. There has also been a boom in fintech that has made the process of self-investing much easier and increased accessibility to a wider range of investment options.

It’s the times when things are unstable that advisors and fund managers have a chance to prove their worth.

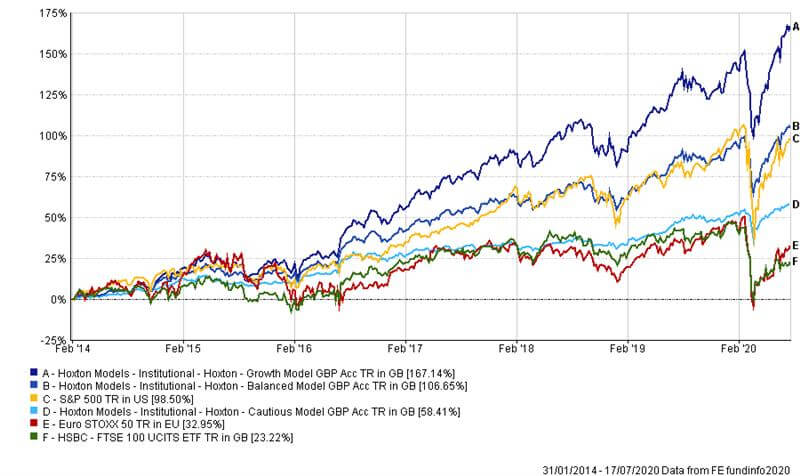

Starting with fund managers, the below chart shows some of the best performing actively managed funds vs an equivalent ETF.

These actively managed funds have vastly outperformed their benchmark and only cost an average of 0.5% more than their equivalent ETF. The time when they have outperformed the most has been since the markets dropped off earlier this year. The managers of these funds have rebalanced to really capitalize on the opportunities that were there at that time.

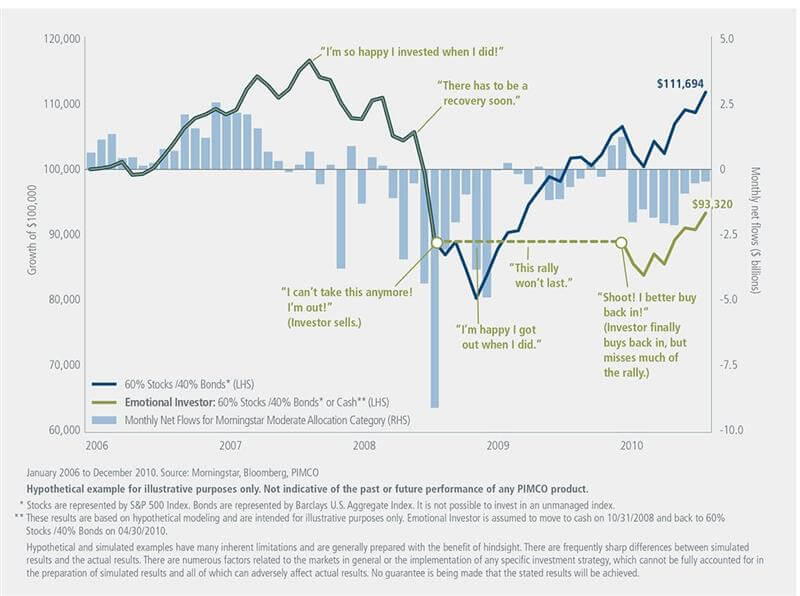

The role of the advisor comes into play more than ever during these uncertain times. Self-investors are more likely to panic when things get bumpy and start to second guess their original decisions. If, after all, those original decisions were made due to a book they once read written by a non-investment professional that was recommended to them by someone they don’t even know anymore, it is understandable that a 20-30% drop in the value of those investments over a few days will make anyone question how they have ended up in that situation.

The reality is that almost everyone is in the same boat at that point regardless of the source of their original investment choices. It’s the decisions that are made during the bad times that are critical and self-investors are more likely to become unstuck since all the pressure of their investments and the situation they are currently in, sits squarely with them.

The chart below shows the behavior that causes losses to be solidified and growth to be missed out on.

There are a number of key studies on the subject of receiving advice versus not receiving advice.

A study by Vanguard found that advisers can add over 3% per year in net returns for their clients. They cited behavioural coaching, spending strategy and rebalancing as the largest contributors. Their study also made the valid point that the most significant opportunities for an adviser to add value do not present themselves every year, hence the importance of an ongoing advice relationship.

Russel Investments estimated this to be as much as a 4.4% net increase in annual returns, through a combination of preventing behavioural mistakes, financial planning, tax smart advice and rebalancing

The International Longevity Center has been running a multi-year study on this topic. Here are their most pertinent conclusions:

“Taking advice has added £2.5bln to people’s savings and investments. An ongoing relationship with a financial adviser leads to better financial outcomes, those clients who received ongoing advice had pension wealth 50% greater than those who took one-off advice or none at all. The benefits of advice outweigh any costs associated with it. Once clients understand this it will no longer be seen as expensive. The simple fact is those who take advice are likely to be richer in retirement”

The University of Montreal estimated that the savings of an advised client will be over 2.73X larger over a 15-year period versus a non-advised client. Even over a shorter time frame of 5 years, an advised client will achieve a savings pot 1.58x the size of a non-advised client.

These are significant differences indeed. It is worth noting of course that not all advice is equal and there are many less than perfect advisers out there. It is certainly important to do your due diligence on the advisory company.

Below is a chart showing the performance of our model portfolios. These use a combination of both actively managed funds and ETFs, so the cost is kept down but they can still benefit from the managers that do outperform.

The cautious portfolio has maintained a smooth trajectory even through the recent turbulence, the balanced portfolio had less of a drop than the markets as a whole and recovered quicker. The growth portfolio has come out flying. All have done exactly as they were intended to do.

If you would like our team to have a look at any existing investments you have, please get in touch with us and we would be happy to complete a free, no-obligation comparison between your current portfolio and a portfolio we would recommend you based on your goals and risk profile.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.