On the 1st of July we entered the 3rd quarter of the calendar year. It has been an interesting half year so far with some normal periods and some volatile times. We have not expected it to be a smooth journey out of the pandemic and there are still many obstacles to overcome but markets have shown more stability than we initially thought which has been positive for investors worldwide.

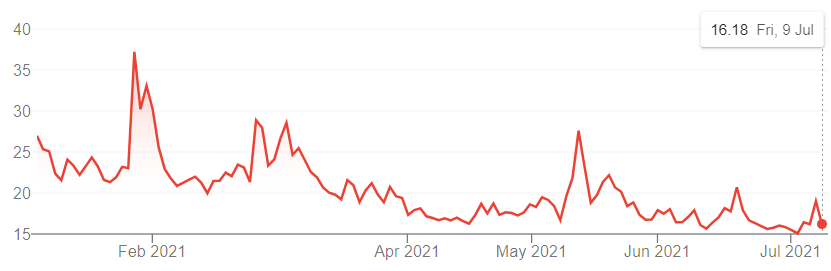

Average market volatility has calmed over the past six months and trading has seemingly stabilised. This can be seen from the below VIX (volatility index) index chart indicating a return to more normal trading conditions. Developed markets have shown resilience which has increased consumer confidence and surprised many industry experts of how strong the financial and current monetary system is. Naturally through this resilience, other alternative currencies have been impacted, with cryptocurrency being the obvious example.

It is worth noting that markets during the summer months generally are more stable which is a natural occurrence as part of seasonal trends.

CBOE VIX Index – Year to Date

The Reason the US Market is Important

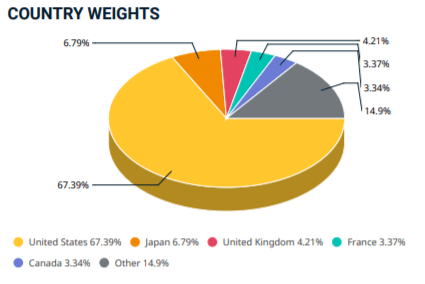

A question we often get asked is – when investing globally why is there such a high percentage allocation to US markets?

The reason being that when investing globally most portfolios are heavily exposed to the US market which is normal considering how the global market is structured. The MSCI World index (an index which tracks the top circa. 1,600 companies in the world) contains an allocation of 67.39% to the US, meaning that if we were to passively invest in global developed markets then our portfolios would have approximately 2/3rds in exposure to the US without making any tactical geographic decisions. This is the reason the US market is so important because when an event impacts the US it substantially impacts the whole portfolio in either a positive or negative way.

US Markets

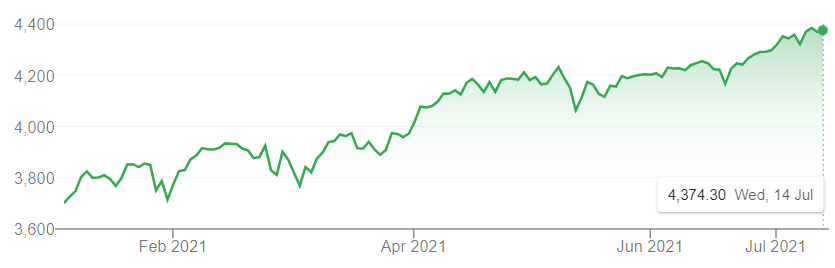

US Stocks continued to perform well this month because more and more states are returning to normal conditions and economic activity has remained positive.

Inflationary pressure has somewhat disappeared although it could be lurking in the background. It could be a matter of sods law that this will be impactful soon, and it is important to be prepared for this eventuality. However, the Federal Reserve are portraying a belief that high inflation should be temporary. Many investment management companies are not taking a dogmatic approach to this and are conducting their own due diligence on the impact of inflation on the markets.

There was a meeting last month at the Federal Reserve which led to two main impacting factors post discussions about the current qualitative easing program (money being released to the economy).

1) It brought about questions surrounding plans to reduce the about of capital being released and

2) It led to forecasts suggesting that interest rates could start to rise at the end of next year which is earlier than what was previously thought.

Referring back to the VIX chart, you can see that this led to a short and small spike in volatility at the end of June. Even though this was the case, the S&P 500 hit another record high during at the same time.

S&P 500 – Year to Date

If the plan is to reduce quantitative easing, then it would mean slowing economic growth and negatively impacting market sentiment. We would expect a rotation back to defensive stocks such as technology and consumer staples if this becomes a reality. Naturally, a well-diversified portfolio covers all eventualities and that is the position we take because having a neutral approach during uncertain times is more defensive and especially with pensions it is the correct approach to have as a lot of these sectors are cyclical.

Jobs in the US are still a concern even though there have been a substantial number of jobs being created over the last few months. For example, there were over 850,000 jobs created in June and a massive 9 million openings in May. Even though this occurred, it is estimated that job increases would take at least another year to restore employment to pre-pandemic levels.

If the impact of the US market is considered substantial there may initiate a switch to safer assets including government backed assets. There is no real way to tell exactly what is going to happen and we have seen the negative impacts of moving to safer assets which naturally leads to the opportunity cost of missing out on growth it the market moves in a positive way. The best course of action to take is to stay true to our risk profiles and spend time in the markets rather than trying to time them.

International Markets

International markets also have been impacted positively by recent growth due to declines in covid cases, rising vaccination rates, and travel resuming. Major markets performed well over the later stage at the end of June off the back of hopes of a global recovery, although they generally lagged the US market.

I look forward to speaking with you before the end of the year at your next portfolio review. We have had a lot of questions about wider financial planning needs, and it would be great to speak with you about the best way to save for meaningful events. This could be anything from saving for children’s university fees or legacy planning to ensure your capital is set up correctly to be passed on to your loved ones if anything unexpected happens. If there are any planning events happening that you would like to discuss, then please contact us to set up a review call.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.