tHE u.s.

Equity markets in the US remained volatile throughout last week, although the focus was shifted towards fourth-quarter earnings. The markets recorded a second consecutive week of positive returns. It was one of the busiest weeks of the fourth-quarter earnings reporting season, with nearly a quarter of the companies in the S&P 500 scheduled to report results.

The Meta Platform had a 26% decline in its stock and wiped out a record-breaking $232 billion of its market cap after a decline in Facebook’s average daily users and a slowdown in revenue growth. On the other hand, Amazon.com’s better than expected earnings helped indexes turnaround on Friday. Energy shares were the best performers as significant oil exporters agreed to a steady increase in production to support high demand.

Official Labour Department jobs report beat consensus expectations by roughly three times, after an increase of 467,000 jobs in January. An improvement in the US job market helped push the US 10-year Treasury Note to 1.93%, returning to pre-covid levels.

EUROPE

In the past week, major European indices saw a decline due to the European Central Bank (ECB) leaving the doors open for possible rate increases this year. Additionally, the eurozone also saw a rise in bond yields due to inflationary pressure and the current stance of the ECB over them.

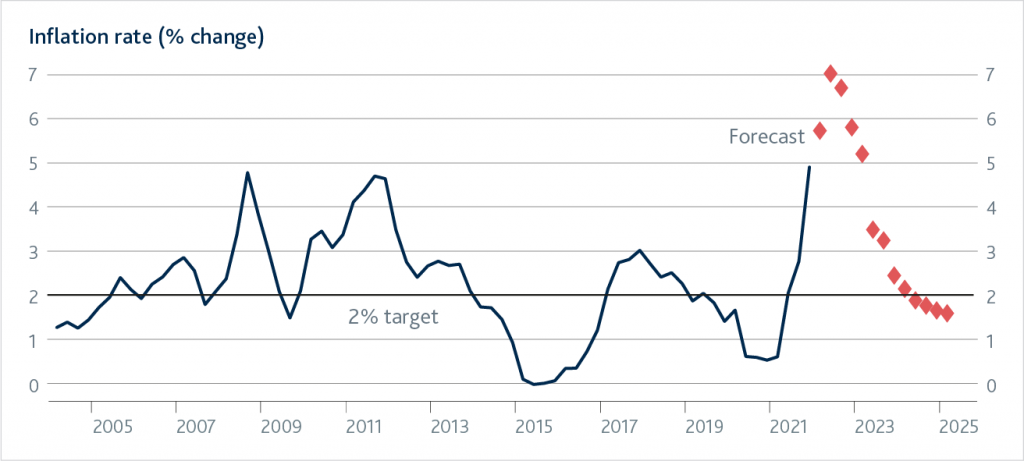

In the meantime, we saw the Bank of England increase its key interest rate by 25 basis points to 0.5%. This comes as the central bank tries to curb inflation with an expectation of peak 7.25% inflation in April. The Monetary Policy Committee (MPC) voted 5 to 4 to increase the bank rate by a quarter-point. The minority wanted a half-point hike. The committee also voted unanimously to stop reinvesting the proceeds from maturing government bonds bought as part of its quantitative easing programs.

(Source: Bankofnegland.co.uk)

aSIAN & pACIFIC

Chinese financial markets were closed during the week of the Lunar New Year. From the economic front, we saw a decrease in the Purchasing Managers Index to 50.1 and the nonmanufacturing gauge—which measures activity in the construction and services sectors—fell to 51.1. This is an essential level since the 50 mark separates expansion from contraction. Hong Kong equities soared upon reopening, ending up as the best market last week, together with other Far Eastern countries.

In contrast, the Japanese stock markets yielded positive returns for the week. This comes due to a Japanese broadcaster’s report indicating that the government could present a policy to ease the ban on entry of non-resident foreigners into the country. The broadcaster also suggested that this policy could be implemented as early as next week.

Further aiding the market rally was points made by Bank of Japan (BoJ) Depuy Governor Masazumi Wakatabe. He reassured that it was too soon to start tightening monetary policy when the country had not achieved its 2% inflation target, hindering economic recovery. He further added that the consumer price index of 2% should be sustained for a certain period and not merely for a few months. Separately, BoJ Governor Haruhiko Kuroda said that it would be hard for inflation to hit 2% unless wages rise in tandem with prices. Therefore, he asserted the importance of maintaining powerful monetary easing to support the economy and help generate steady wage and price growth.

mARKETS FOR THE WEEK

|

|

In Local Currency |

In Sterling Pound |

||

|

Index |

Last week |

YTD |

Last week |

YTD |

|

UK |

|

|

|

|

|

FTSE 100 Index |

0.84% |

1.98% |

0.84% |

1.98% |

|

US |

|

|

|

|

|

S&P 500 Index |

1.57% |

-5.47% |

0.69% |

-5.38% |

|

Europe |

|

|

|

|

|

Euro Stoxx 50 Index |

0.10% |

-3.53% |

0.88% |

-3.61% |

|

Asia |

|

|

|

|

|

Nikkei 225 Index |

2.70% |

-4.69% |

1.74% |

-5.03% |

|

Hang Seng Index |

4.34% |

5.03% |

3.49% |

5.22% |

|

MSCI Emerging Markets Index |

2.13% |

-0.86% |

1.64% |

-0.73% |

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.