Financial advisers often get a bad reputation, and actually that is often for good reason. The job of a wealth management company is to do a better job of managing your wealth than you could yourself, otherwise there really is no point in paying for the service. Unfortunately, some of the industry is failing to outperform what any individual could achieve on their own. We think it’s time that underperformance was highlighted and people who hold portfolios that have not performed, ask for explanations.

What to do if you think your portfolio hasn’t grown as much as it should have?

The first step is to get some clear data. Find out exactly what your portfolio’s performance has been over a set time period and also what it is annualised for that time period.

The next step is to compare that data to benchmarks. The easiest benchmarks to use would be major indices such as the SP 500 or FTSE 100. The data for these indices will come up if you just google the name of the index.

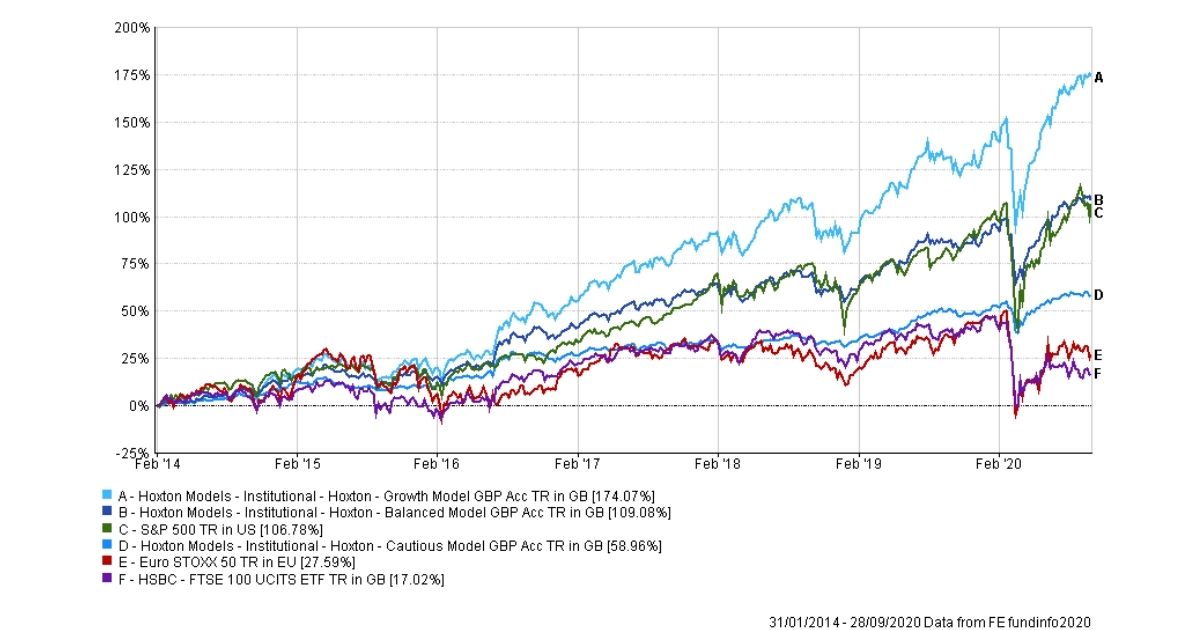

For example, this chart shows Hoxton’s model portfolios against ETF tracker funds for the US, UK and EU markets (Data from 31/01/2014 up until 28/09/2020):

You can see that both our growth and balanced portfolios have outperformed the index tracking funds for these markets. Our cautious portfolio has still outperformed the UK and EU and behaved in a far less volatile manner.

These ETF tracking funds are cheap and easily accessible. If your managed portfolio has not outperformed them, why are you paying for the management service?

If you would like us to run a portfolio analysis for you, we are happy to do this and to send you the visualised data that we get from FE Analytics.

This underperformance issue is highly prevalent, and it is worth everyone checking their portfolio regardless of the reputation of the firm they are with or the experience they believe their advisor to have.

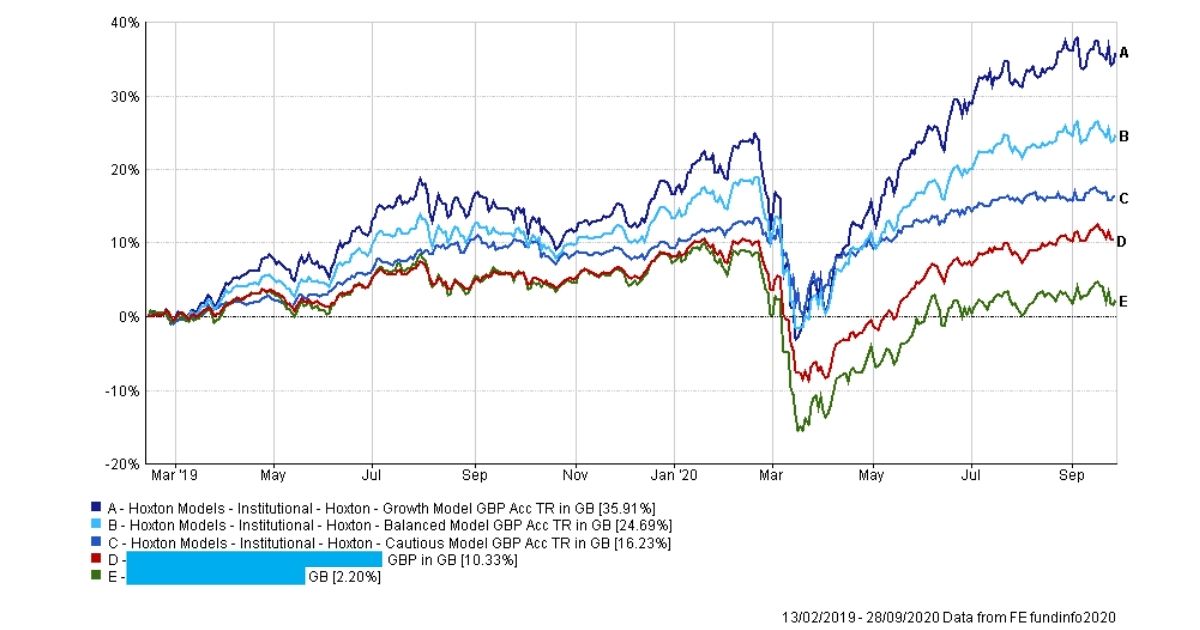

The chart below aims to highlight this prevalence by showing our model portfolios when compared to some of the largest advisories in the industry. The names of the competitors have been covered as we don’t want to make disparaging comments about anyone specific. ‘D’ on the chart is the balanced fund for a large offshore advisory and ‘E’ is the balanced fund for one of the largest UK based advisory companies:

It is very easy for people to equate bigger businesses with better business, however, in finance the proof is in the pudding and it would be unwise to assume you are receiving the best advise without analysing the numbers.

If your portfolios performance is a concern for you, speak to us today.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.