Do you know the impact of Inflation & Deflation on your savings?

The world, in general, has a natural deflationary bias, the result of natural market tendencies putting downward pressure on costs and prices: emerging markets’ productivity (production of goods by ever-cheaper materials and labour), shifting demographics resulting in declining aggregate demand in advanced economies, technological breakthroughs and the energy revolution, among other root causes.

Meanwhile, central banks and the US Fed, in particular, fend off deflation through interest-rate policy and money printing, because deflation would have disastrous consequences for the national debt, government revenue and the banking system. The effect of these inflationary measures is to cause a decline in real income – that is to say, a general increase in prices and a fall in the purchasing value of money. In times when wages stagnate or fall, household real income shrinks.

Average inflation in the UK was running at 2.51% Y/E 2018 compared to Y/E 2017 and is expected to hover around 2% per year until 2022.

In the US it was very similar at 2.54% Y/E 2018 and is also projected to hover around 2%.

(Considering annual inflation rates in recent years, a 2% inflation rate is a very moderate projection.)

This means that a product bought today for 100 U.S. dollars will cost 102 U.S. dollars next year, and so on.

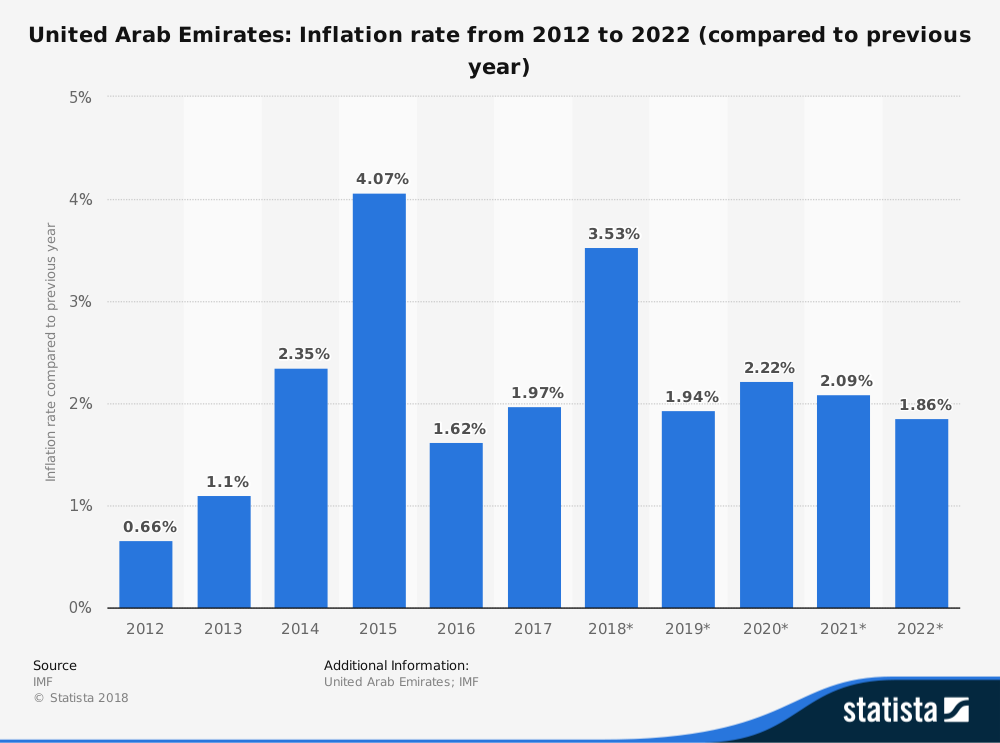

Here in the UAE, the Consumer Price Index showed inflation running at 3.53% Y/E 2018, though it’s projected to drop to 1.94% in 2019. Click here for the UAE inflation rate information.

So our purchasing power is eroded year-on-year, meaning we have to spend more or consume less to maintain a balance.

To “encourage” us to spend more, governments and central banks set low nominal interest rates. This condition in which inflation is higher than the nominal interest rate produces negative real rates (known as the Fisher Effect).

A well-known, high street bank here in the UAE offers a nominal interest rate of 0.25% p.a. on its standard savings account, calculated on the monthly balance. Therefore, the real interest rate will be negative at 1.69%.

In a simple interest scenario, a savings amount of $1,000 would earn $30.00 in nominal interest.

1000 × 0.0025 × 12

But the real purchasing power of that amount would be $797.20.

1000 × -0.0169 × 12

The same bank offers a fixed deposit account, with a top nominal interest rate of 2.05% over 60 months. Even this product will barely keep you up with inflation while tying up your capital.

So if keeping your money in a conventional bank savings account will cause a loss of the value of your savings in real terms, you cannot afford the cost of not investing.

How to outsmart the Fed?

The Fed would want us to invest in risky assets, such as stocks and real estate, to prop up collateral values in those markets. Indeed, the DJIA has increased almost 1,250% since 1986, while the S&P500 index has increased over 1,000%.

However, the stock market is volatile, and many savers are inherently conservative (with good reason). A 70-year old retiree doesn’t want to invest in stocks because he could easily lose 30% of his retirement savings when the next bubble bursts. A 22-year old professional saving for a down payment on his first property will avoid stocks for the same reason.

However, us savers have a range of alternatives that offer inflation-beating rates of return depending on the savings amount, comfortable risk profile and tenure. Our team is very knowledgeable about the current products on the market. Please get in touch and we can assist in finding the right products to meet your financial goals.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.