“Buy the dip” – The mentality of an entire generation of investors

As markets have continued to decline over the last month amid a range of ongoing fears, investors will be deciding whether this presents a buying opportunity or is a sign of worse to come. For one category of investor the answer is clear, buy the dip.

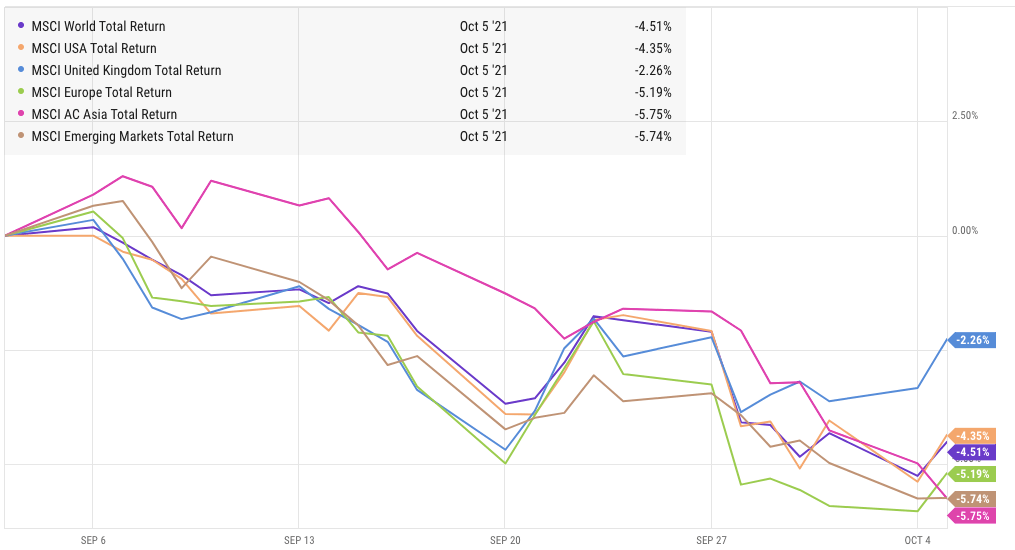

Markets last month

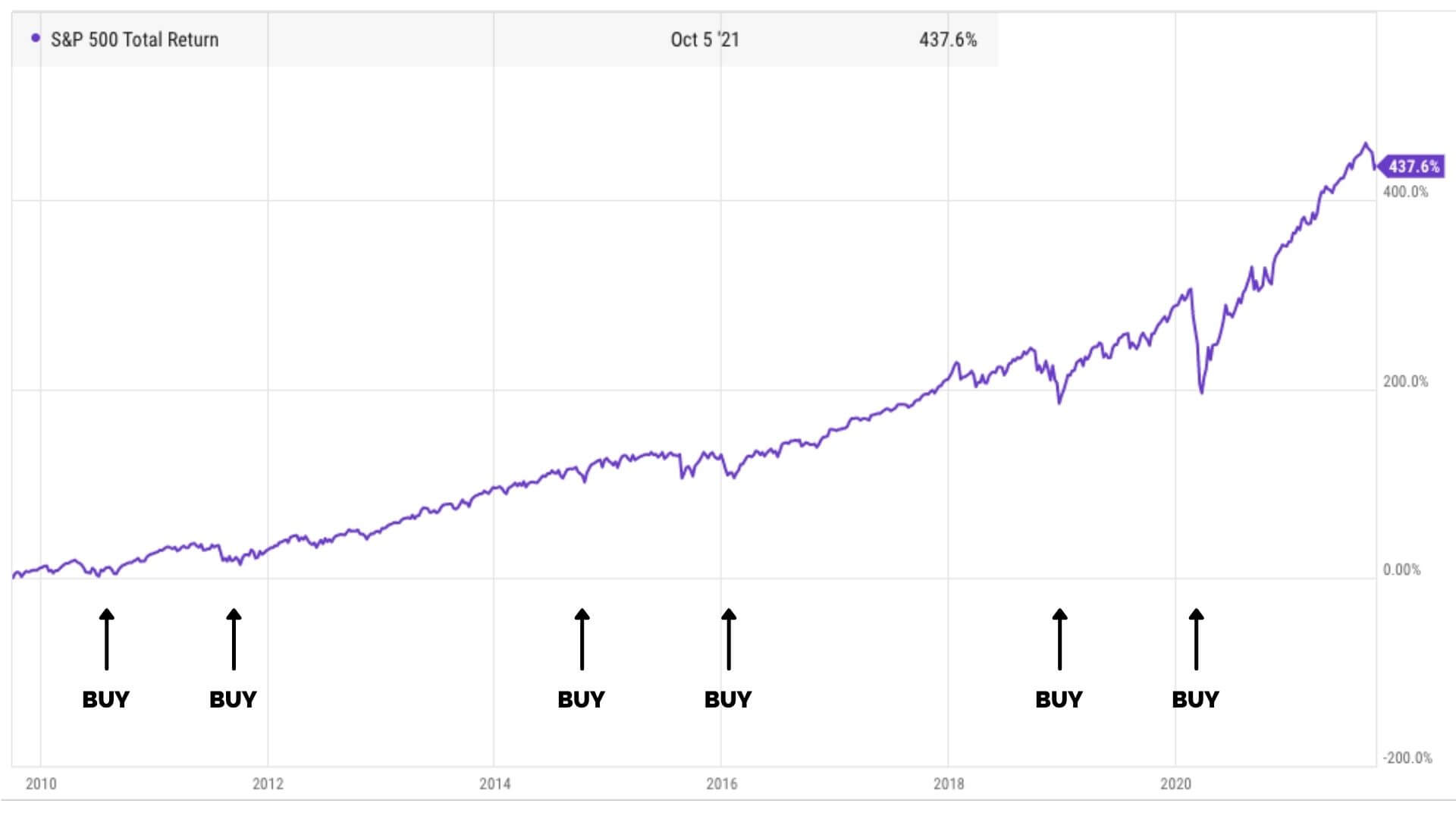

For anyone who’s investing experience dates back less than 12 years, this will seem like a fool proof plan given over that time, this has been a highly successful strategy. The fact is market dips have been consistently followed by new highs time and time again and this has created an incredibly powerful positive feedback loop. Since 2009 there has been a total of 24 dips in the S&P 500 of more than 5%, with the quickest recovery taking just 7 days.

The longest correction period since 2009 was 267 days, less than a year for the markets to recover from a 15.2% drop, triggered by Greece defaulting, oil prices tumbling and drama in North Korea. The largest recent drop in the S&P 500 occurred just last year at the start of the coronavirus pandemic, with a drop of 35.4%. The recovery from that took just 33 days.

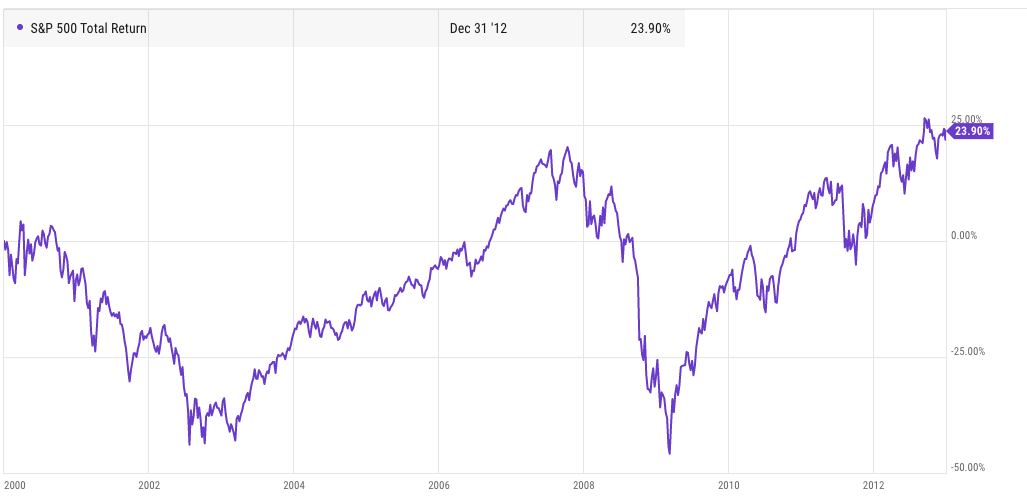

However, if you go back further you will see that the recovery time is not always so fast.

Between the end of the 90’s and the early 2010s it is important to remember that markets didn’t have such speedy recoveries. Understanding your risk profile and tapering down your exposure to volatile assets as you approach retirement is critical. Whilst the ‘buy the dip’ mentality would have eventually paid dividends throughout this period; this would have only worked out for those with longer investment time frames who could afford to remain invested and wait. It may not have been such a good time for those who needed their money.

Speak to one of our advisers for a comprehensive review of your portfolio and to make sure it is in line with your risk tolerances and rebalanced where necessary.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.