BANK OF ENGLAND RAISE INTEREST RATES TO 0.5%

As expected, yesterday the Bank of England (BOE) voted to increase the base rate of interest to 0.5%. The vote meant that the interest rate was increased from 0.25% and increased by 25 basis points. Therefore, for the first time since 2004, the Bank of England have agreed to back-to-back successive interest rate hikes.

The Monetary Policy Committee (MPC) is made up of 9 members who vote on policy decisions for the Bank of England. The vote yesterday resulted in a 5-4 majority decision to raise interest rates to 0.50%. However, it is worth pointing out 4 members of the 9 MPC members voted for interest rates to climb 50 basis points to 0.75%. This near miss on a 50-basis point hike is seen as a hawkish outlook for the UK economy, with fears of persistent high inflation along with higher wage demands among times of slowing economic growth.

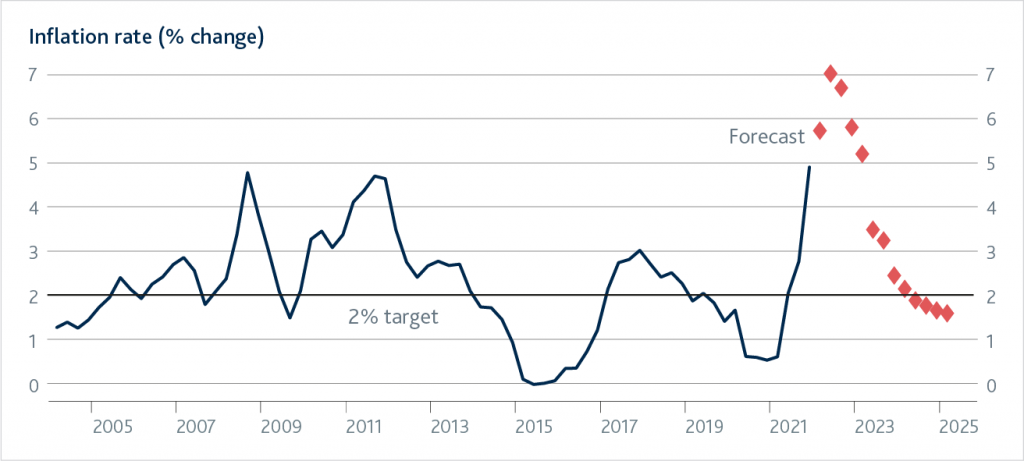

The fundamental principle behind raising interest rates again is to tackle rising inflation. The chart below from the Bank of England itself highlights the forecast for inflation, which to reach a peak of 7.25% in April this year. This is a revised figure, higher than the forecasted peak of 6% inflation the BOE predicted in December.

With this forecast it, we will not see UK inflation falls below the long-term target of 2% until 2024. To ensure the long-term inflation target is met, the BOE agreed unanimously not to reinvest the maturing government bonds in March to the tune of £28 Billion and will not reinvest a further estimated £70 billion of matured government bonds over the next two years.

Following this, the BOE will sell all £20 billion held in corporate bonds with the aim to have relinquished all these bonds by the end of 2023.

After the announcement of the interest rate hike, the pound strengthened against the dollar and weakened against the euro. The main driving force behind this is inflation expectations. As the pound sits in between the dollar and euro, for inflation expectations. The dollar has higher inflation than the UK, hence the dollar devalued against the pound. However the Euro has lower inflation than the pound, hence the pound devalued against the euro.

Speak to one of our advisers today to find out what the interest rate hike means for you.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.