5 WAYS USING A LIMITED COMPANY TO HOLD PROPERTY CAN BENEFIT YOU

Purchasing property through a private limited company is becoming increasingly popular for those buying property in the UK, and for good reason. There are many advantages to doing this and the process is becoming much simpler.

As the demand for this kind of structuring increases, companies are popping up that can manage the whole process for you for very affordable fees. So, why would you use a limited company to buy property?

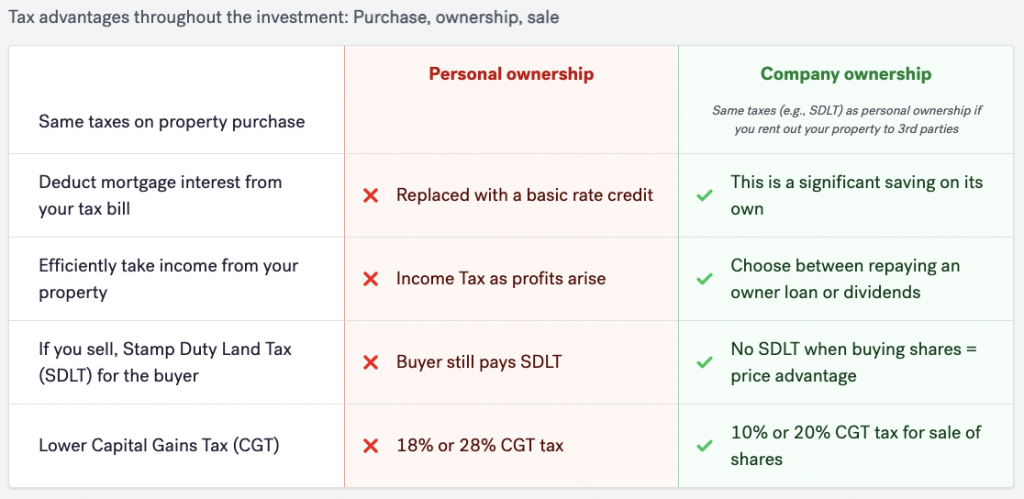

TAX EFFICIENCIES

A non-resident investor purchases a property for £500,000 using an interest-only mortgage with a rate of 3%. They purchase using a limited UK company.

When they sell the property after 5 years, it could yield 14% more than someone who made the exact same investment, but bought in their own name.

LIMITED PERSONAL LIABILITY

Having your property investments within a private limited company means they are separate from your other affairs. This means that should any issues arise, your other assets outside the company, such as your family home, are safer.

EASY TO BUY AND SELL WITH OTHERS

You can have up to 8 shareholders in the company, which makes it a lot easier and safer to partner with others on investments.

You can buy and sell shares without stamp duty land tax and conveyancing lawyers, which also means you can transfer shares in a day rather than in the 6-8 weeks it usually takes for property conveyancing.

IMPROVED INHERITANCE PLANNING

Shares are subject to inheritance tax, just as property is.

However, with shares you are able to more flexibly manage your inheritance tax.

For example, there is a mechanic where you can gift value to another person, and over time the inheritance tax liability on this reduces until, after 7 years, it is 0%.

With shares you can slowly gift value away e.g., 10% of your company every year.

This separates economics from control, so you can gift away the economics but retain control, which is a solution many parents like.

COMMERCIAL LENDING OPTIONS

Getting a mortgage as an expat can be a chore and typically results in lenders offering higher rates on the mortgage.

When lending to a business, lenders tend to have lower income requirements for company vs personal ownerships. They also tend to have lower rental stress tests.

BONUS: RETAIN YOUR FIRST-TIME BUYER STATUS

As an added bonus, buying through a company means, if it is your first property, you will still be classed as a first-time buyer should you buy another one in your own name.

If you have property in the UK or are interested in investing in UK property and would like to know more about this model, get in touch with us today.

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.