All investors will know that 2022 has been a particularly volatile year for investments. Most sectors have seen loses. In fact, global stock markets saw the worst start to the year since the second world war.

In the UK, inflation has just hit its highest level in 40 years, rising to 9.1%. Political instability, rising energy and fuel costs and ongoing supply chain issues mean you’d be forgiven for thinking that there’s very little economic good news on the horizon.

However, does this mean you should be delaying your property investment choices? Our advice is no. Let’s look at why UK property is still a great long term investment.

Historical market performance is consistently strong

UK property has a long history of increasing value.

In the last 5 years, house prices have increased by 25%.

In the last 10 years, house prices have increased by more than 50%.

In the last 14 years, house prices have doubled.

Whilst there have been occasional dips, such as the 2008 financial crisis, house prices have always recovered. The trend is clear.

Why are increasing house prices important to property investors? Because when you come to sell your property, you’ll get more for it than you paid for it. You’ll see capital growth. This is one of the two ways that investors make money on property and sits alongside your rental income over the period that you own property.

Current market performance is exceptional

The UK property market is currently seeing record levels of growth. In June 2022, the average house price hit a new record of £271,613 according to Nationwide. The Halifax has it pegged higher still at £294,845.

All indices show startling month-on-month and year-on-year growth. Halifax report that June 2022’s 13% yr-on-yr growth rate is the largest for 18 years.

This is the continuation of a trend that started with Covid but has continued over the last two years.

High demand and rising rents

On top of rising property prices, asking rents across the country are surging. This is good news for buy-to-let landlords who will find that not only are their properties in high demand, but that the rents they can command are strong.

Rightmove’s Q2 2022 report showed that the quarter’s 3.5% jump in asking rents is the second highest in ten years. Since the start of the pandemic, asking rents outside London have increased 19%.

The national average asking rent outside London is at a record £1,126 pcm, an 11.8% year-on-year increase.

In London, the average asking rent is now £2,257, which is a massive 15.8% up year-on-year. Residents are starting to return to the capital and the surrounding commuter belt as professionals return to the office.

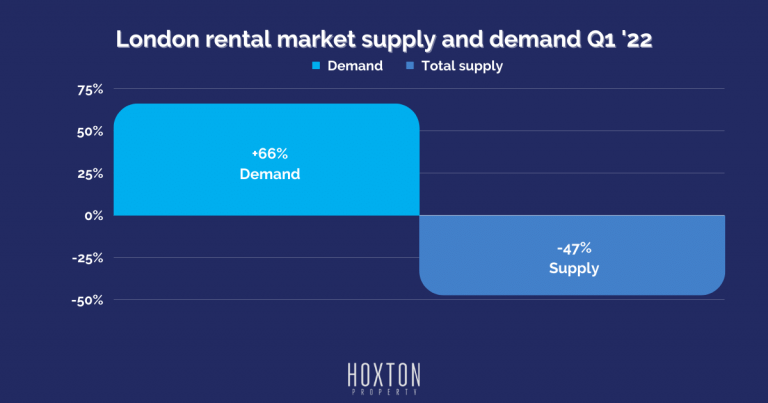

This influx of new renters is reflected in the huge demand for rental accommodation against a backdrop of limited supply. Rightmove shows that rental demand is up 6% compared with last year and available properties are down 26%.

In London, for Q1 2022, demand was sitting at +66% whilst supply was way behind at -47%.

As an investor, if you’re lucky enough to be able to get a property, you should buy as soon as possible to avoid missing out.

Mortgage interest rates are still historically low

The Bank of England base rate has risen recently, from an historic low of 0.1%. As of July 2022, it sits at 1.25%.

Despite this rise, it is still substantially lower than where we were at the start of the century when it was 5.75%. In fact, BOE base rate has been as high 14.88% back in 1989.

Viewed in context, we’re still firmly in an era of low-cost borrowing. Which means investors can still take advantage of leverage and purchase property without huge initial outlays.

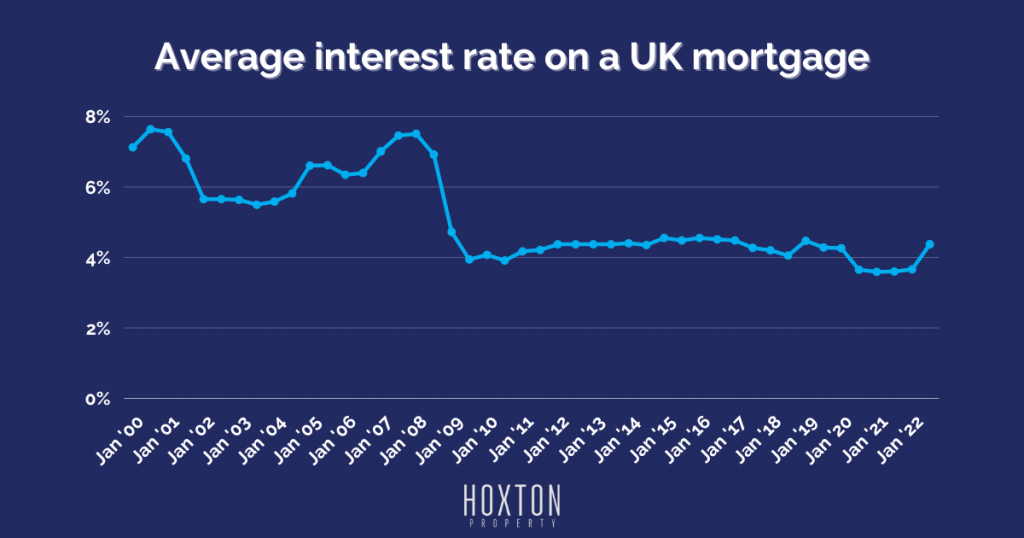

The base rate underpins the cost of mortgages and similarly, although mortgage rates are currently rising, they’re still lower than they have been in the last 20 years.

Currently, the average interest rate on a UK mortgage is 4.38%.

That’s still almost half the rate that borrowers were paying on average back in 2008. And it’s on a par with average rates over most of the 2010s.

Cautious investors may decide to wait to see what happens, hoping for a better rate to appear. This won’t happen.

Remember, whilst your capital is sitting in the bank, you’re losing money on it thanks to inflation.

As always, to get the best rates, property investors should still find the right deposit and have good credit ratings. This hasn’t changed. In the face of rising mortgage costs, it’s better to move now and secure your best rate than to delay.

How property protects investors from inflation

Property is often described as “inflation-proof”. But what does this mean?

It’s generally the rule that as inflation increases, so do property prices. As a tangible asset, the house or apartment an investor buys will always have value associated with it. Unlike a share, it would take truly exceptional circumstances for it to become worthless.

In a detailed analysis of the relationship between house prices and inflation, the Man Institute concluded that whilst there are different types of inflation (controlled inflation vs hyperinflation) that can affect house prices accordingly, they “expect any inflation in the coming years to be manageable and, if anything, supportive of house prices in many areas.”

In this way, inflation actually helps your capital grow when you invest in property.

On the other hand, if you’ve left your capital uninvested, inflation is slowly eating away at it.

Should you invest in UK property?

Our advice is not to wait to invest in UK property. Sitting on the fence during a time of high inflation isn’t going to help you financially.

We can help you by working on a cash flow projection that can answer any questions you might have about the likely performance of your investment over the next 10 years. If you’d like to have a no-obligation consultation with us, please get in touch.

The UK property market is still in a period of high growth and, although it may slow down, it has shown proven long-term resilience.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.