We continue to express our belief that time in the markets is more beneficial than timing the markets over the long run. This is our backbone through the tension of political and economic climate changes, and we hope the below examples provide confidence for investors who may be caught up in trending media and socially shared content.

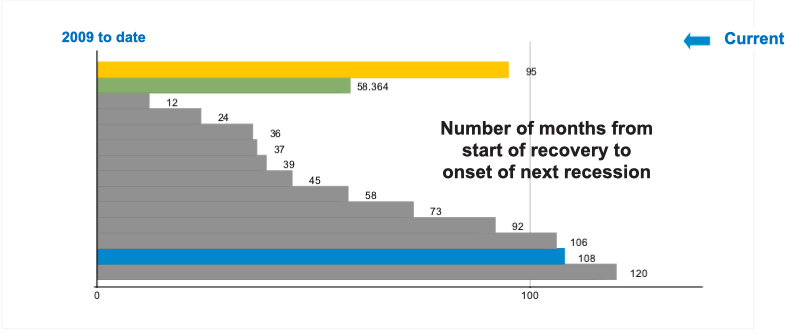

The below chart shows the length in months of each bull market from 1950 to 2018. Interestingly, the blue bar shows the number of months of the current bull market which is considerably longer than the average bull market length post 1963 shown in yellow. Despite this, indicators signal that growth is set to continue.

During this bull market run, if you had sat out on the side lines due to economic events you would have missed out on all the growth. Brexit is an example where in 2016, market sentiment was considered negative, however most markets in 2017 rallied in what could be said was the best year since 2013.

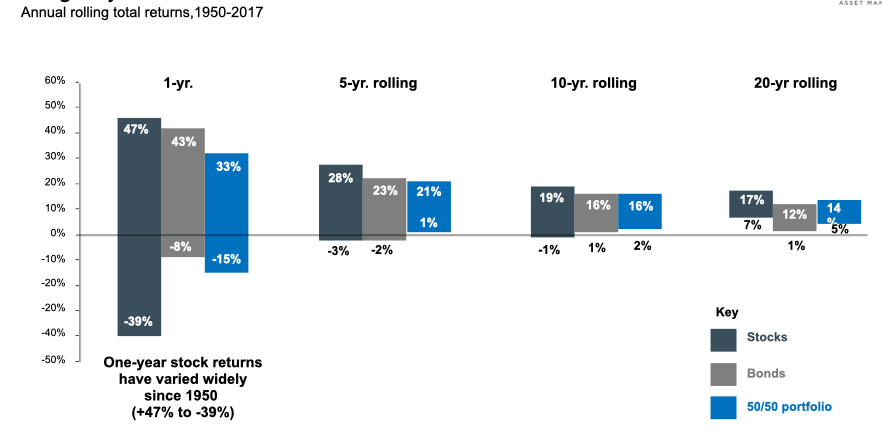

This second chart is shows the effect of investing over the long term. It reveals the annual rolling total returns from 1950. The blue bars show the effect of investing in a 50/50 portfolio in stocks and bonds over a rolling time frame. On the far right for example, the 20 year rolling average return for a 50/50 portfolio was between 5% and 14%. This is what drives confidence in holding over the long term and takes the focus away from the highs and lows of market volatility.

Staying focused on the longer term aspects of financial planning, we concentrate on the 20 year rolling average even if you have stopped paying into your investment. It is likely that you will be holding on to your portfolio for a much longer period of time.

Brexit

The Brexit situation does not seem to be reflecting the fantasy from 2016. Theresa May lost the vote again on whether her deal was acceptable on the 12th March by 149 votes. MPs do not like the government’s despondent deal and they do not want to leave the EU with no deal either. Article 50 has been extended, based on the agreement of all 27 member states. Legally, the UK is now due to leave the EU on 27th May.

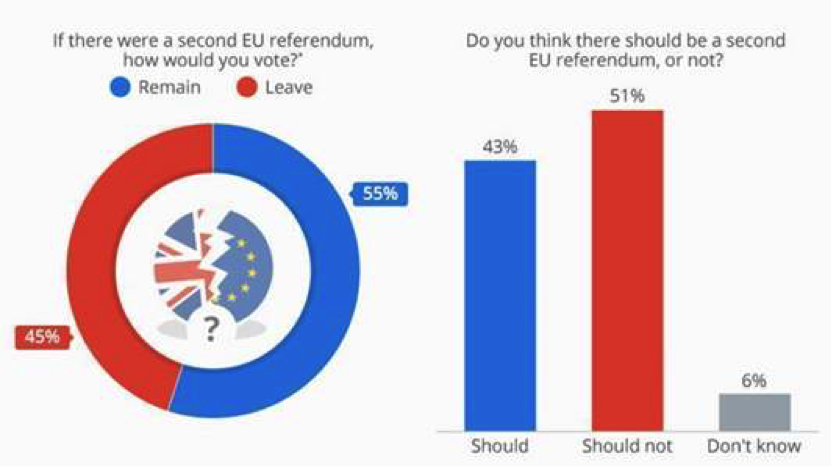

How would a second referendum pan out? According to the below ComRes survey, the majority said they do not want a second vote but if it were to come to that, 55 percent said they would vote ‘remain’ in what would be a reversal of the original result in June 2016.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.