Once again, all house price indices are showing that UK property continues to grow in value reaching new highs.

National reports have highlighted record prices, with the Halifax pointing to an average house price of £294,845. This represents a 1.8% month-on-month rise – the steepest monthly increase since 2007.

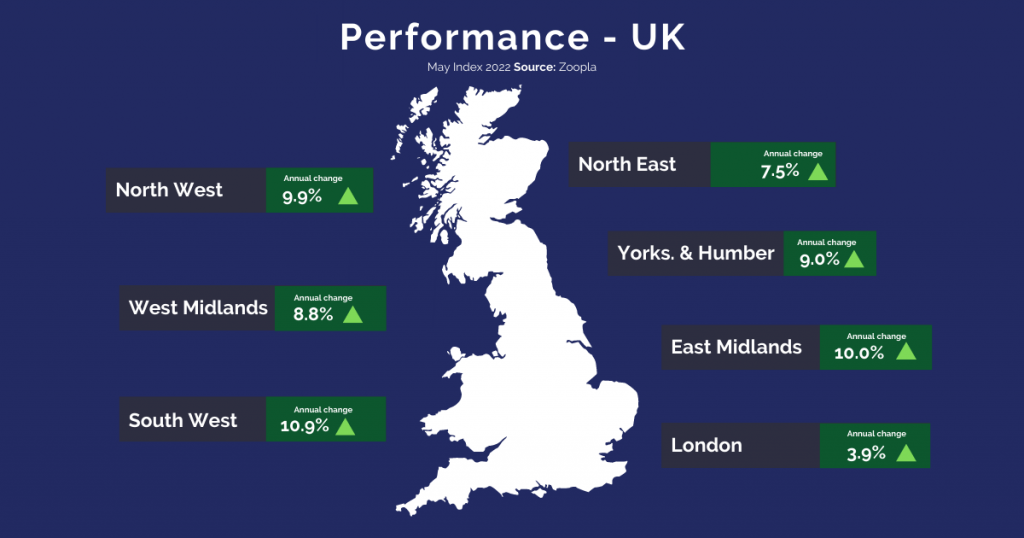

Zoopla agrees, reporting an 8.4% year-on-year increase in average house price. Buyer demand is still very high, and it’s this that is contributing to ever-increasing house prices. According to Zoopla’s data, demand for homes in the 4 weeks to 26th June is up 40% compared to the 5-year average.

Of course, with so little supply to go around, this pushes up house prices and leaves many would-be homeowners turning to the rental sector. It’s a win-win for investors who will see good capital growth as well as sustained tenant demand for their properties.

Market forecasts continue to point upwards

The ongoing cost-of-living pressures aren’t impacting the UK housing market. Halifax managing director Russell Galley explains, “This is partly because, right now, the rise in the cost of living is being felt most by people on lower incomes, who are typically less active in buying and selling houses. In contrast, higher earners are likely to be able to use extra funds saved during the pandemic.”

Longer term predictions for capital growth suggest a softening of the market, but overall property prices will continue to rise.

In November 2021, Savills was forecasting UK-wide price growth of +13.5% by 2026. Since then, it’s pulled back a little, although their prediction of +12.9% house price growth is still considerable. Knight Frank have actually predicted even more growth, suggesting average UK prices will rise by +16.9% in the next 5 years.

The rental market performs well

As well as rising property prices, recent reports have highlighted an ongoing increase in average rents.

Homelet show an average rent for a new tenancy of £1,103 pcm, which is up 1.1% from May 2022. Every region in the UK has seen annual growth of this measure, with London leading the way at 14.9%. It’s for this reason that we recommend investors explore the capital and the commuter belt for buy-to-let bargains.

Should you invest in UK property now?

The supply and demand imbalance isn’t going to be solved soon which means that, despite increasing inflation, UK property will continue to provide an excellent return for investors, both in terms of rental income and capital growth. If you’d like to discuss how Hoxton Property can help you invest today, please get in touch.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.