Financial Resolutions for 2023

As another year comes to a close, it is time to reflect on your finances from the last year and your goals for the new one. The new year is an opportunity to reset your financial targets in an achievable and measurable way. It is easy to fall into the new year resolution excitement of setting ambitious targets with incredible motivation and eventually losing steam. To avoid the overwhelming task of navigating all your finances all at once and maintaining consistency in wealth creation, here are a few financial resolutions to bring in 2023 from our in-house financial advisers.

1. Calculate Your Net Worth

Start with where you are. Your net worth is an overview of your current financial standing regarding assets and liabilities. This snapshot is the starting point to determine whether you are on track to meeting your long-term goals or whether they need re-adjustment. Calculating your net worth should be an annual undertaking, which helps you plan your expenses and savings.

2. Revisit your investing targets

We are very often inclined to take the path of least resistance. In the case of money, if accessing and spending your money is more accessible than making an effort to save and invest it, you’ll likely spend it. Consider setting up an auto deposit wherein a specific amount gets transferred to your investment account.

It will reduce the effort required while allowing you to save and invest. To this end, you also need to draft your monthly budget. Based on your expenditure in the past year and average monthly income, you can build a rough estimate of your expected spending and opportunities to invest. This is a great time to reevaluate your emergency fund too.

3. Work towards paying your debts

You can go further even if you have a working plan to reduce your debts. If you received your annual bonus at work or a promotion with a raise, you could divert part of them to reduce your liabilities. Consolidating your loans so that you can give up varying interest rates for a single rate lower on a single loan makes debt much easier to manage.

4. Rebalance Your Portfolio

The stock market is unpredictable, bringing highs and lows all year round. Because of changing values, the assets in your portfolio will have different returns at the end of the year, thereby changing their weightage. Rebalancing is when you buy or sell assets to achieve the asset composition you want in your portfolio. In this process, consider your risk appetite and tax liabilities and always speak with a qualified financial adviser.

5. Review Your Life Insurance

Go over your insurance to determine the protection you need. Compare that with your current coverage. You may need to decide whether you need more insurance or a particular plan. Alternatively, you may not have to make any changes this year. However, maintain the practice of reviewing your insurance regularly.

How Do You Keep Up with Financial Resolutions?

Now that you have a few resolutions for 2023, how do you maintain them? As discussed earlier, make it easier by automating aspects and building them into your habit. For savings, put them out of reach in an account you cannot easily access. To analyse your market positions and net worth, break them down into manageable chunks to plan for them. Although some expenses are inevitable, try cutting down on others to save or productively invest them.

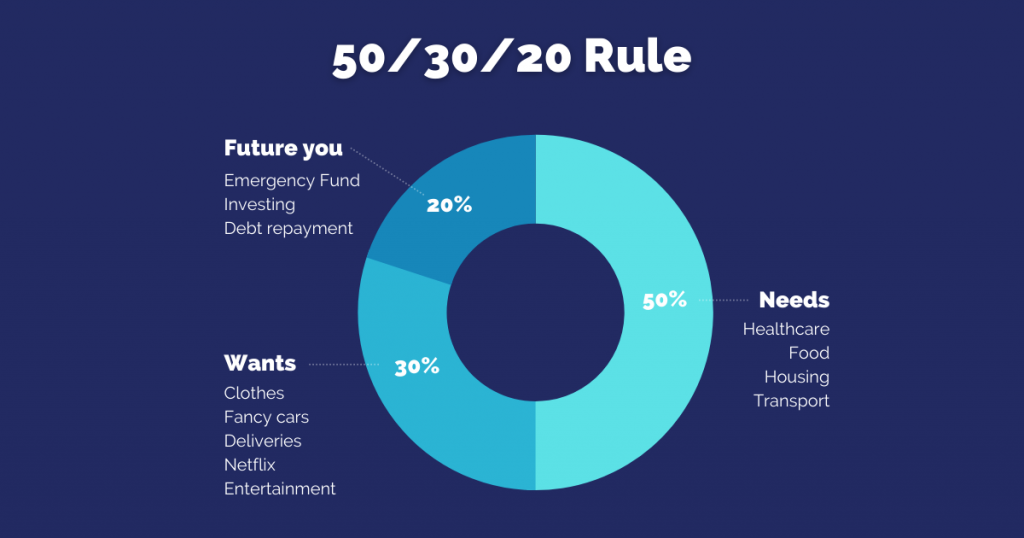

The 50-30-20 Budget Rule?

This 50-30-20 budget rule is a broad blueprint for managing finances. 50% of your income should go towards your essentials: utilities, food, healthcare, etc. These are expenses that can neither be eliminated nor compromised. The following 30% are for your wants. If you’ve been considering taking a holiday, some other form of entertainment or non-essential expense, they fall under this category. Lastly, save and invest the remaining 20% for your future and paying off debt.

With these clear financial resolutions to ring in the new year, you can take charge of your wealth and future. For further assistance in managing your finances, Hoxton Capital Management’s tailored services ensure that your money works for you. Schedule a call with our adviser and start planning for the new year.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.