DOES INCREASING BOND YIELDS REDUCE TRANSFER VALUES?

The biggest misconception that we come across is that a defined benefit pension valuation will increase over time. Often, when we speak to people regarding their DB pensions and obtain a transfer value from the scheme, they understandably believe that the valuation will be higher if they have it revalued in a few years.

Unfortunately, this is not how transfer values work. When you request a transfer valuation, the scheme will calculate the expected cost to purchase the same benefits as they are offering you. In simple terms, what amount you would need as a lump sum to get the same annual income you would get from remaining in the scheme?

How is it calculated?

This is a complicated calculation that each scheme may do slightly differently. These are calculated by understanding the Cash Equivalent Transfer Value (CETV). The main thing to understand is that the calculation uses variables, such as interest rates and bond yields. Therefore, as those vary the valuation will also change, but not necessarily as an increase.

What is the relationship between transfer values & bond yields?

The relationship between transfer values and Gilt (Bond) yields is inverse. As Gilt yields (specifically the yield on a 5-year Gilt) increase, the transfer valuation will go down. This is because a pot of money that is invested into bonds will now pay a higher return and therefore, the size of the pot needed to obtain the same amount of income as the scheme was promising the member, can now be smaller.

What can you do?

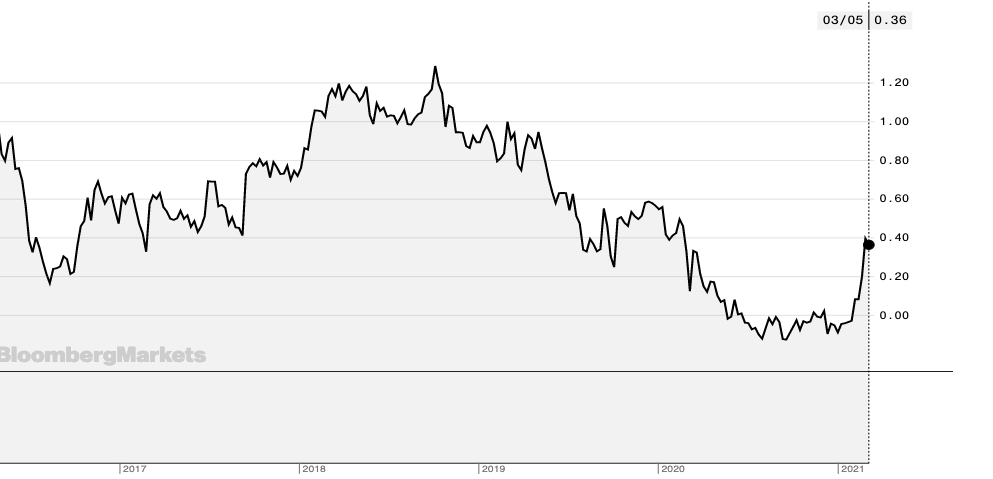

This chart shows the yield on a 5-year Gilt:

If you requested a valuation in the last 3 months, it will likely be a higher amount than if you request a new one today. Transfer values are usually guaranteed for 3 months, so if you proceed with a transfer now then they will honour the amount they have calculated.

If you have not requested a valuation on a pension you have in the UK and are interested in doing so, this should not stop you from requesting one. Even though the valuation may come back slightly lower than it would have last year when compared to historical data it will still be comparatively high. Moreover, what is now lower than a few months ago, may well be looked back on as high when compared to values in 3-6 months.

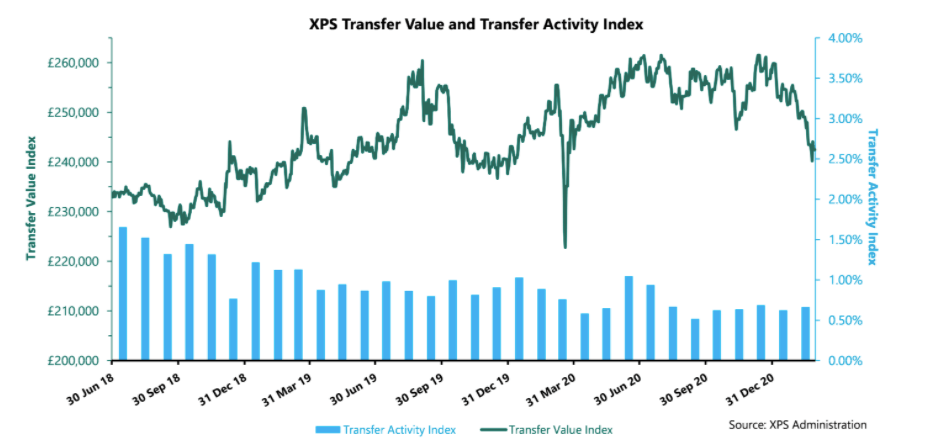

This chart shows the yield over a much longer time frame and puts into perspective how low yields still are, and conversely how high valuations may still be:

XPS provide a transfer value index:

You can see the inverse relationship between yields and the values being offered and also that even with the recent drop in values, the values currently being offered are higher than a couple of years ago.

If you have a private pension in the UK and would like to request a valuation, get in touch with us today.

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.