The British pound sinks against the dollar

The British pound is tanking against the U.S. dollar, hitting a new low on Monday the 26th after the UK’s biggest tax cuts by Kwasi Kwarteng.

What happened over the weekend?

- The Sterling tumbled against the dollar to below $1.08, over the weekend hitting the lowest point since 1985.

- On Friday, the new UK finance minister Kwasi Kwarteng announced a GBP 45bn debt-financed tax-cutting package much to everyone’s surprise.

- This is a massive gamble as he is betting that this will kickstart the economy by facilitating growth and reducing any effects of an impending recession.

- This prompted a massive day of trading as many are sceptical of this approach.

This spending spree has come at an odd time as the chancellor wishes to borrow huge sums of money at high-interest rates compared to two years ago, with an ambitious expansionary fiscal policy. What is even stranger is he wishes to execute this plan while the Bank of England is in the middle of contractionary monetary policy execution by raising rates. The National Institute of Economic and Social Research said that BoE would have to raise rates to 5% and keep them there until at least 2024.

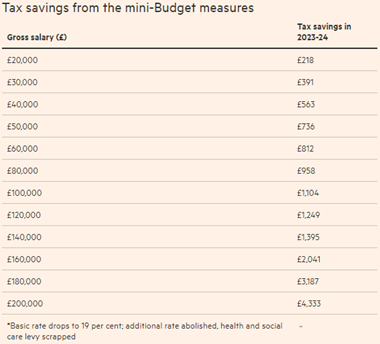

Kwasi Kwarteng unveiled a tax-cutting budget that also included supply-side reforms and a GBP 60 billion energy support package for households and businesses aimed at achieving 2.5% annual growth. The package includes reductions in the top and basic rates of income tax and the cancellation of increases in national insurance contributions and corporation tax. The below table shows how the new tax cuts will affect the different income families in the UK

PwC has published a report which seems to suggest that UK GDP growth to averages between 3.1% and 3.6%, followed by two years of slow, or even negative GDP growth. They also state headline inflation could reach 17% next year although with the new energy price cap that number has been revised to 10% to 13%. It’s clear that the chancellor has his eyes set on future growth-related problems but that could be at the cost of making current inflationary issues worse.

What to do?

In the long run, dips in the market are unseen as the years go on. The biggest mistake people can make is to be shaken by temporary setbacks. It is important during these times of volatility that you are speaking with your financial adviser as they will help you with understanding the market volatility and that these times won’t last.

Planning and strategising for volatile times takes understanding the markets. If you are looking to safeguard your investments but are not sure of how to do so, speak to one of our advisers today. With tailor-made guidance on your finances, you can be better equipped to deal with volatility.

About Author

How can we help you?

If you would like to speak to one of our advisers, please get in touch today.